Buyer Persona Research That Actually Informs Strategy (Not Just Slides)

Most persona research produces pretty decks that nobody uses. Here's how to build personas that actually change how you sell, market, and build product.

Your marketing team spent six weeks building buyer personas. Beautiful slides with stock photos, demographic details, goals and challenges, and fictional names like "Manager Mike" and "Director Donna." The deck gets presented once, saved to a shared drive, and never referenced again.

Three months later, your sales pitch still leads with features. Your marketing campaigns target the wrong pain points. Your product roadmap doesn't align with what buyers actually care about. The personas didn't change anything because they weren't built to be actionable.

After conducting persona research at four companies and watching most of it fail to drive real change, I've learned the pattern: effective persona work isn't about creating comprehensive profiles. It's about uncovering the specific insights that change how you go to market.

Here's how to do persona research that actually matters.

Why Traditional Personas Fail to Drive Action

Most persona templates ask you to document:

- Demographics (age, title, company size)

- Goals and motivations

- Challenges and pain points

- Information sources and influences

- Buying process involvement

This creates personas that are theoretically complete but practically useless. When a sales rep is preparing for a call with a VP of Engineering, they don't reference the persona doc to learn that VPEs "care about team efficiency" (obvious) or "read Hacker News" (not helpful).

The problem is personas built from templates instead of decisions. You're documenting everything instead of uncovering the insights that would change specific behaviors.

The Decision-Driven Persona Framework

Start with the decisions your personas need to inform:

For sales: What talk track wins this persona? For marketing: What value prop resonates with this persona? For product: What capabilities does this persona evaluate? For customer success: What outcomes does this persona measure?

Each decision needs specific insights, not general background.

The Four Research Questions That Actually Matter

Instead of comprehensive persona profiles, focus research on four questions:

Question 1: What triggers this persona to start looking for a solution?

Generic answer: "They need to improve efficiency"

Specific answer: "When their team grows past 15 people and they're spending 10+ hours weekly on manual reporting, they realize their current tools don't scale. The trigger is usually a bad quarter where leadership asks for data they can't produce quickly."

The specific answer reveals timing (at 15+ people), pain point (manual reporting time), and catalyst (leadership pressure). This tells sales when to reach out, marketing what hook to use, and product what problem to solve first.

Question 2: What's the one thing that must be true for this persona to choose you?

Generic answer: "We need to show ROI"

Specific answer: "They need to see that our tool works with their existing data infrastructure without requiring data team resources. If implementation requires weeks of data team time, they won't move forward regardless of features."

This reveals the non-negotiable requirement. Everything else is nice-to-have. This one thing becomes your differentiation anchor.

Question 3: Who else has to agree, and what do they care about?

Generic answer: "The CFO cares about cost"

Specific answer: "Engineering VPs can't buy without Finance approval for anything over $25K annually. Finance wants to see cost-per-user math that's lower than current tool stack. They also need SOC 2 compliance because it affects their cyber insurance rates."

This reveals the actual buying committee dynamics, budget thresholds, specific evaluation criteria, and non-obvious requirements (insurance implications).

Question 4: What makes them trust a vendor in this category?

Generic answer: "They want good reviews and references"

Specific answer: "They don't trust marketing claims. They trust peer recommendations from their specific Slack communities (r/programming, DevOps subreddit) and want to see public documentation before talking to sales. They'll test the product themselves before bringing it to their team."

This tells you which channels matter (Reddit, public docs), which don't (outbound sales), and how to structure your buying process (product-led, not sales-led).

How to Get These Insights: The Interview Framework

You need 8-12 interviews per persona (mix of customers and prospects).

Interview structure that works:

Part 1: The trigger story (10 minutes)

"Walk me through what was happening when you first started looking for a solution like ours. What specific incident or situation made you think 'we need to change something'?"

Listen for: Specific events, metrics that triggered action, who raised the issue, timeline from trigger to search.

Part 2: The evaluation process (15 minutes)

"Once you started looking, how did you go about it? Who got involved? What did you evaluate? What almost made you not move forward?"

Listen for: Evaluation criteria, stakeholders involved, deal-killers, information sources, competitive alternatives considered.

Part 3: The decision factors (10 minutes)

"What ultimately made you choose [product]? What was the one thing that had to be true? What would have made you choose differently?"

Listen for: True differentiators (not what you think they are), necessary vs. sufficient conditions, trade-offs they accepted.

Part 4: The aftermath (5 minutes)

"Now that you've been using it, what actually matters most? What did you think would be important that turned out not to be?"

Listen for: Real vs. imagined value, unexpected benefits or drawbacks, what would make them churn.

Translating Interviews into Actionable Insights

Don't create persona documents. Create decision tools:

For sales: Battle cards by persona

One page per persona with:

- Opening hook that matches their trigger

- Discovery questions that uncover their specific evaluation criteria

- Demo flow that addresses their priorities in order

- Objection handling for concerns unique to this persona

- Stakeholder map showing who else to involve and when

For marketing: Messaging hierarchy by persona

- Primary value prop (the one thing they care about most)

- Supporting benefits (ranked by importance to this persona)

- Proof points (specific format they find credible - case studies vs. data vs. peer reviews)

- Content preferences (long-form technical docs vs. short videos vs. interactive demos)

For product: Feature priority by persona

- Must-have (they won't buy without this)

- Important (affects deal size or cycle time)

- Nice-to-have (differentiator but not dealbreaker)

- Irrelevant (you think they care, but they don't)

This ensures you're building for what actually drives decisions, not assumptions.

The Research Methods Beyond Interviews

Interviews are best, but supplement with:

Sales call analysis

Listen to 20 sales calls with each persona type. Note:

- What questions do they ask?

- What objections do they raise?

- What makes them lean in vs. zone out?

- What language do they use to describe their problem?

Your sales team's recorded calls are persona research gold if you actually analyze them systematically.

Support ticket analysis

Read 50 support tickets from each persona. Group by theme. What confuses them? What do they expect that you don't deliver? What delights them unexpectedly?

Review mining

Read G2/Capterra reviews filtered by company size and industry matching each persona. Sort by "most critical" to see what matters enough to complain about publicly.

Common Research Mistakes That Waste Time

Mistake 1: Interviewing only customers

Customers already chose you. Interview prospects who chose competitors to learn why you lose. Interview prospects who chose no one to learn why deals stall.

Mistake 2: Asking what they want instead of observing what they do

People are terrible at predicting their own behavior. Don't ask "What features would you like?" Ask "Walk me through the last time you evaluated a tool in this category. What did you actually look at?"

Mistake 3: Creating too many personas

Most B2B products have 2-3 personas that matter: Economic buyer, champion/user, and sometimes technical gatekeeper. More than that and you dilute focus.

Mistake 4: Making personas demographic instead of psychographic

"Director-level at 100-500 person companies" is demographics. "Risk-averse, needs peer validation, prioritizes reliability over innovation" is psychographic. The latter actually predicts buying behavior.

How to Know Your Persona Research is Working

Good persona research changes behavior within 30 days:

For sales: Win rate improves because pitch matches what personas actually care about For marketing: Conversion rates increase because messaging addresses real triggers For product: Feature adoption grows because you're building what personas need For CS: Retention improves because onboarding matches how personas define success

If your personas don't change these metrics within a quarter, you researched the wrong things or didn't make insights accessible enough.

Keeping Personas Current

Personas drift as markets evolve. Update when:

- You enter new segments (different company sizes, industries, or geographies)

- Competitive dynamics shift (new entrants change evaluation criteria)

- You lose 3+ deals for the same reason (reveals changed expectations)

- Win rate drops for a specific persona (their needs evolved, your positioning didn't)

Quarterly, review 5 recent wins and 5 recent losses with each persona. If patterns have changed, update your decision tools immediately.

Persona research isn't an artifact to create. It's intelligence to extract that changes how you compete. Focus on insights that drive decisions, not comprehensive profiles that sit in decks, and the research becomes strategy instead of documentation.

Kris Carter

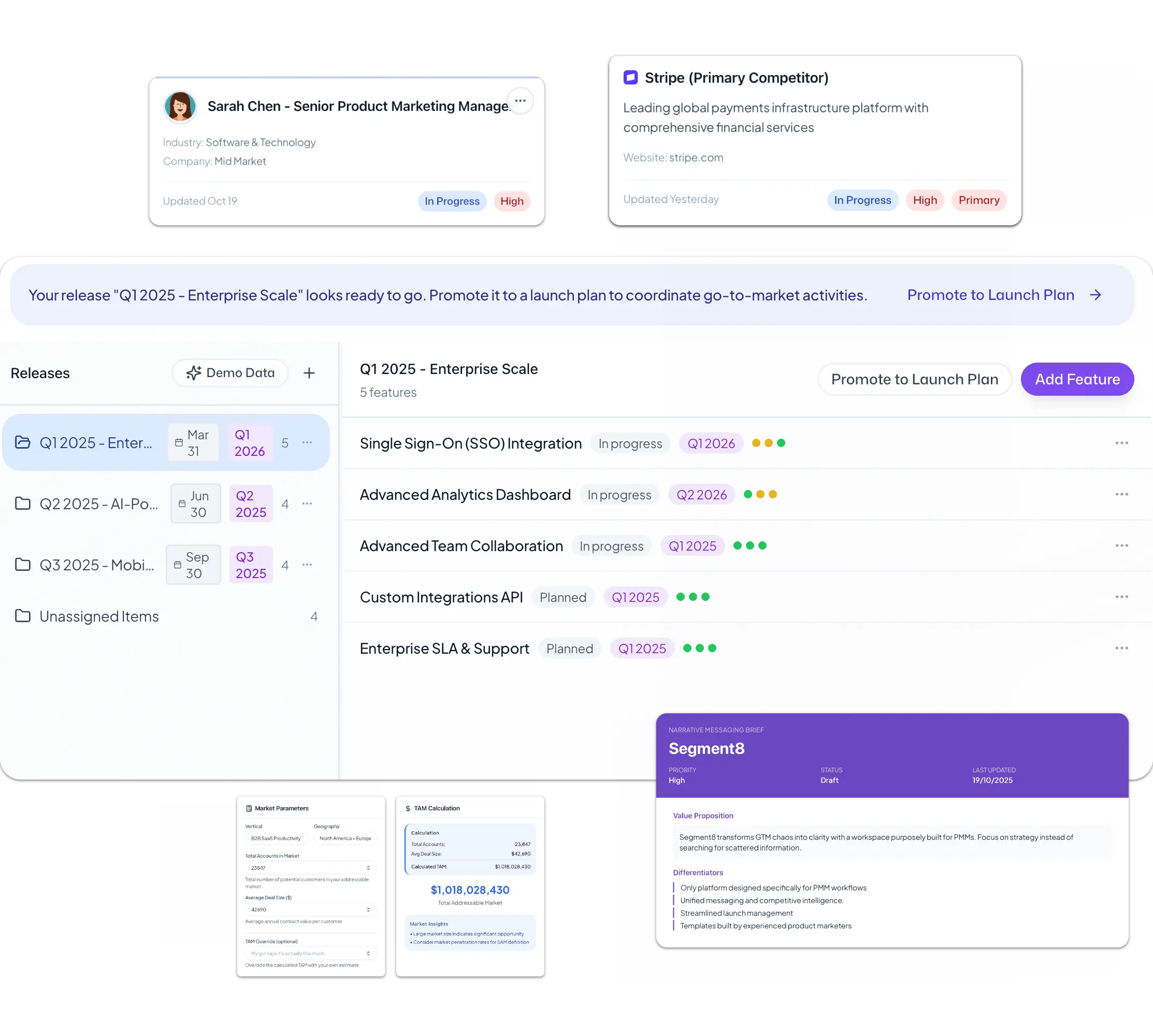

Founder, Segment8

Founder & CEO at Segment8. Former PMM leader at Procore (pre/post-IPO) and Featurespace. Spent 15+ years helping SaaS and fintech companies punch above their weight through sharp positioning and GTM strategy.

More from Market Research

Ready to level up your GTM strategy?

See how Segment8 helps GTM teams build better go-to-market strategies, launch faster, and drive measurable impact.

Book a Demo