Competitive SWOT Analysis That Actually Drives Strategic Decisions

Most SWOT analyses produce lists nobody acts on. Here's how to run competitive SWOT that reveals strategic opportunities and guides resource allocation.

Your team completes a SWOT analysis. Strengths: "Great product, strong team." Weaknesses: "Limited resources, brand awareness." Opportunities: "Market growing." Threats: "Competitors." The document gets filed away. Nothing changes about how you compete.

SWOT analysis fails when it produces generic observations instead of specific strategic insights. The framework itself isn't broken—the execution is. Done right, SWOT reveals exactly where to attack competitors, which capabilities to build, and which battles to avoid.

After conducting competitive SWOT analyses at four companies and watching some drive major strategic pivots while others produced useless lists, I've learned the pattern: effective SWOT is specific, comparative, and actionable. Generic SWOT is waste of time.

Here's how to run SWOT that actually informs strategy.

Why Traditional SWOT Produces Generic Lists

Most SWOT analyses start with internal brainstorming: "What are our strengths?" Everyone shares opinions. The result is self-assessment without competitive context.

Typical output:

Strengths: Good product, smart team, great culture

Weaknesses: Small company, limited budget, no brand

Opportunities: Market growing, new segments, partnerships

Threats: Competition, economic uncertainty, technology changes

This tells you nothing actionable because:

- No comparison to competitors (are your strengths actually differentiated?)

- No link to customer outcomes (do customers care about these strengths?)

- No resource implications (which weaknesses matter enough to fix?)

- No timing considerations (when do opportunities become accessible?)

Effective SWOT is comparative (vs. competitors), customer-validated (what customers actually value), and strategic (what you should do different).

The Competitive SWOT Framework

Start with competitors, not yourself

Most teams do SWOT on themselves in isolation. Better approach: do SWOT on top 3 competitors first, then yourself.

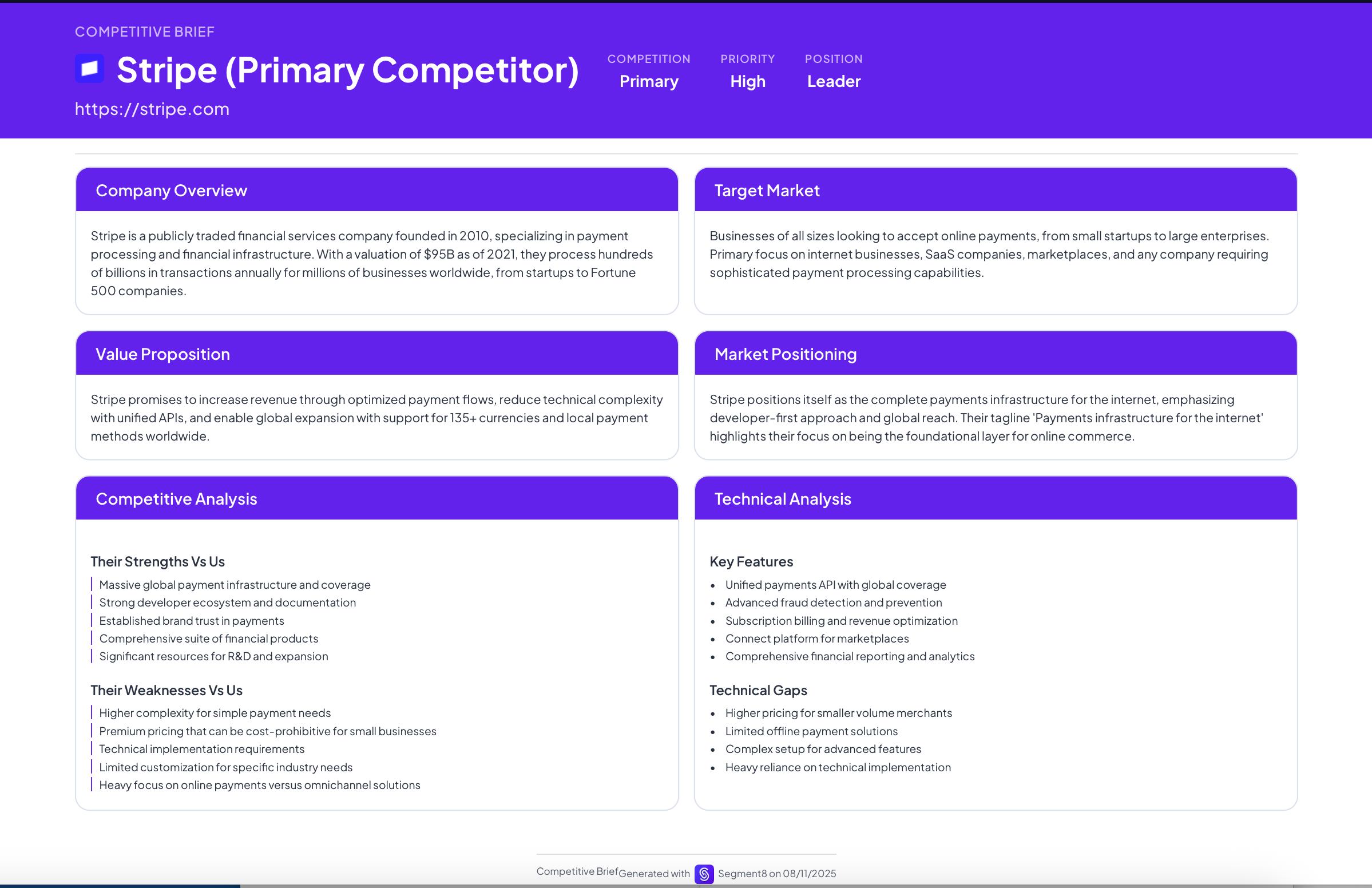

Step 1: Pick the right competitors to analyze

Don't analyze everyone in your space. Pick:

- The competitor you lose to most frequently (deal-level threat)

- The competitor with most market share (market leader)

- The fastest-growing competitor (emerging threat)

Three competitors is enough. More dilutes focus.

Step 2: For each competitor, assess through customer lens

Strengths (From customer perspective, not yours)

Don't list: "They have good engineering team" Do list: "Their integration ecosystem is 3x larger than ours—customers can connect 200+ tools vs. our 65"

Don't list: "They're well-funded" Do list: "They offer 60-day implementation guarantee backed by penalty clauses—customers perceive lower risk"

Every strength should be specific, measurable, and customer-facing.

Weaknesses (What customers complain about)

Don't list: "Their UI is old" Do list: "G2 reviews show 42% of users cite 'steep learning curve' and 'dated interface' as negatives. Average time-to-proficiency is 3 months vs. our 3 weeks"

Don't list: "They're not innovative" Do list: "Product update frequency is quarterly. We ship weekly. Customers note 'slow to adapt to needs' in 28% of reviews"

Every weakness should be validated by customer evidence, not your opinion.

Opportunities (What they could do but haven't)

Don't list: "They could expand internationally" Do list: "They have 0 European presence despite 35% of TAM being outside North America. If they localized in next 18 months, they'd threaten our UK/Germany traction"

Every opportunity should be strategic gap they could exploit to threaten you.

Threats (What could disrupt them)

Don't list: "New competitors entering" Do list: "Their enterprise focus leaves mid-market underserved. Three well-funded startups targeting mid-market launched in last 12 months. Could erode their growth."

Every threat should be specific market dynamic that could weaken their position.

Step 3: Now assess yourself comparatively

After analyzing competitors, assess yourself through same lens—but now it's comparative.

Strengths template:

"We are stronger than [Competitor X] at [specific capability] because [evidence]. This matters to [customer segment] because [outcome]."

Example:

"We are stronger than Competitor A at onboarding speed. Our average time-to-first-value is 8 days vs. their 45 days (based on customer interview data from 20 switches). This matters to mid-market companies because they lack implementation teams and need fast ROI."

Weaknesses template:

"We are weaker than [Competitor X] at [specific capability] because [gap]. This costs us [business impact]. Customer quote: [actual feedback]."

Example:

"We are weaker than Competitor B at enterprise security. We lack SOC 2 Type 2 and FedRAMP. This costs us 8-10 enterprise deals quarterly (sales team data). Customer quote from lost deal: 'We loved the product but couldn't get past security review without SOC 2.'"

Opportunities template:

"[Market gap] exists because [current solutions inadequate]. We could capture this by [specific action] which would [expected outcome]."

Example:

"Healthcare vertical is underserved. Current solutions don't handle HIPAA compliance natively—it's bolted on. We could build healthcare-specific version with native compliance, security, and workflow that would open $85M addressable market based on LinkedIn company count and average spend data."

Threats template:

"[Competitive dynamic] could weaken our position if [condition]. Probability: [high/medium/low]. Timing: [timeframe]. Mitigation: [action]."

Example:

"Competitor C could add our differentiated feature (real-time collaboration) to their enterprise platform. Probability: High (they've hired 3 engineers from similar companies). Timing: 12-18 months based on typical development cycles. Mitigation: Build network effects and switching costs through integrations and workflow automation."

From SWOT to Strategy: The Translation Framework

SWOT is useless without strategic translation. Here's how to convert analysis to action:

Strategic play 1: Strength exploitation

For each strength vs. competitors:

Which customer segment values this strength most? → Target them What marketing message emphasizes this strength? → Feature it prominently Which sales scenarios should lean into this strength? → Train reps to emphasize

Example from SWOT:

Strength: "45-day faster implementation than Competitor A"

Strategy:

- Target customers with urgent timelines (new fiscal year starts, merger integrations, seasonal peaks)

- Marketing: Lead with "live in 30 days" guarantee

- Sales: Ask discovery question "What's your timeline for going live?"

Strategic play 2: Weakness mitigation or acceptance

For each weakness:

Can we fix this weakness in 6 months? → If yes, add to roadmap with priority Can we partner to mitigate? → If yes, find partner with this capability Is it only weakness for specific segment? → If yes, avoid that segment Can we reframe as different positioning? → If yes, position around alternative strength

Example from SWOT:

Weakness: "Lack enterprise security certifications"

Strategic options:

- Fix: Invest $200K and 6 months to get SOC 2 (if targeting enterprise)

- Mitigate: Partner with security vendor who provides enterprise layer

- Accept: Focus on mid-market where this isn't required; position as "built for speed, not bureaucracy"

Decision depends on where you want to compete.

Strategic play 3: Opportunity prioritization

For each opportunity:

What investment is required? (time, money, team) What's expected return? (revenue, market share, strategic value) What's competitive response likely? (do they have same opportunity?) What's our competitive advantage in capturing this? (why us vs. others?)

Example from SWOT:

Opportunity: "Healthcare vertical underserved"

Prioritization:

- Investment: 2 salespeople, 3 engineers for 6 months, $150K marketing = $500K total

- Expected return: $2M ARR within 18 months (based on segment size and penetration assumptions)

- Competitive response: Unlikely in short term (competitors focused on horizontal expansion)

- Our advantage: 2 early customers in healthcare can serve as references

ROI: 4x in 18 months. Pursue this.

Strategic play 4: Threat preparation

For each threat:

What triggers would signal threat becoming real? What's early warning system? (competitive monitoring, customer signals) What's contingency plan if threat materializes?

Example from SWOT:

Threat: "Competitor C could add real-time collaboration feature"

Preparation:

- Trigger: Job postings for relevant engineers, product roadmap leaks, customer beta invitations

- Early warning: Monitor their GitHub activity, employee LinkedIn updates, customer community

- Contingency: If they launch, emphasize our multi-year head start, deeper workflow integration, and advanced capabilities they won't have at launch

The One-Page Strategic SWOT Output

After full analysis, create one-page summary for exec team:

Competitive Position Summary:

Our Moat (Top 3 strengths that drive wins):

- [Strength] → [Strategy to exploit]

- [Strength] → [Strategy to exploit]

- [Strength] → [Strategy to exploit]

Critical Gaps (Top 3 weaknesses costing revenue):

- [Weakness] → [Fix, mitigate, or accept decision]

- [Weakness] → [Fix, mitigate, or accept decision]

- [Weakness] → [Fix, mitigate, or accept decision]

Growth Opportunities (Prioritized):

- [Opportunity] - ROI: [X], Timeline: [Y], Investment: [Z]

- [Opportunity] - ROI: [X], Timeline: [Y], Investment: [Z]

Competitive Threats (With mitigation plans):

- [Threat] - Probability: [%], Timing: [months], Mitigation: [plan]

- [Threat] - Probability: [%], Timing: [months], Mitigation: [plan]

This one-pager drives quarterly strategic planning.

How to Keep SWOT Current

Markets shift. Competitive dynamics evolve. SWOT goes stale.

Update cadence:

Quarterly light refresh (2 hours):

- Review win/loss data (what changed in competitive dynamics?)

- Update strength/weakness based on recent customer feedback

- Reassess threat probability based on competitive moves

Annual deep analysis (1 day):

- Full SWOT on top 3 competitors

- Validate all assumptions with fresh customer research

- Reassess strategic priorities

Trigger-based updates:

- Competitor raises funding → Reassess threats

- Major competitor product launch → Update strengths/weaknesses

- You lose 3+ deals to same competitor for same reason → Deep dive on that weakness

Common SWOT Mistakes

Mistake 1: Confusing internal capabilities with customer-valued strengths

"We have great engineering team" isn't a strength unless it produces outcomes customers value (faster shipping, more reliable product, better customization).

Mistake 2: Listing weaknesses without assessing materiality

Some weaknesses don't matter. "Small marketing team" is only a weakness if it's causing you to lose deals. If you're winning through product-led growth, team size doesn't matter.

Mistake 3: Identifying opportunities without validation

"We could sell to enterprise" is only an opportunity if enterprises want to buy from you. Validate before calling it opportunity.

Mistake 4: Treating SWOT as research project, not strategy input

SWOT isn't the goal. Strategic decisions based on SWOT are the goal. If SWOT doesn't change your roadmap, budget, or GTM strategy, you did it wrong.

The Strategic Test

Good SWOT analysis answers these questions:

- Where should we compete? (Which segments, use cases, or markets favor our strengths?)

- How should we position? (Which strengths should we emphasize and against which competitors?)

- What should we build? (Which weaknesses must we fix vs. accept?)

- Where should we invest? (Which opportunities have best ROI?)

- What should we monitor? (Which threats need contingency planning?)

If your SWOT doesn't clearly answer these five questions, it's decorative analysis, not strategic input.

Competitive SWOT done right transforms how you allocate resources, choose battles, and position for wins. Done wrong, it's corporate busywork that produces lists nobody acts on. Be specific, be comparative, be action-oriented. Let competitors do generic SWOT. You do strategic SWOT that drives real decisions.

Kris Carter

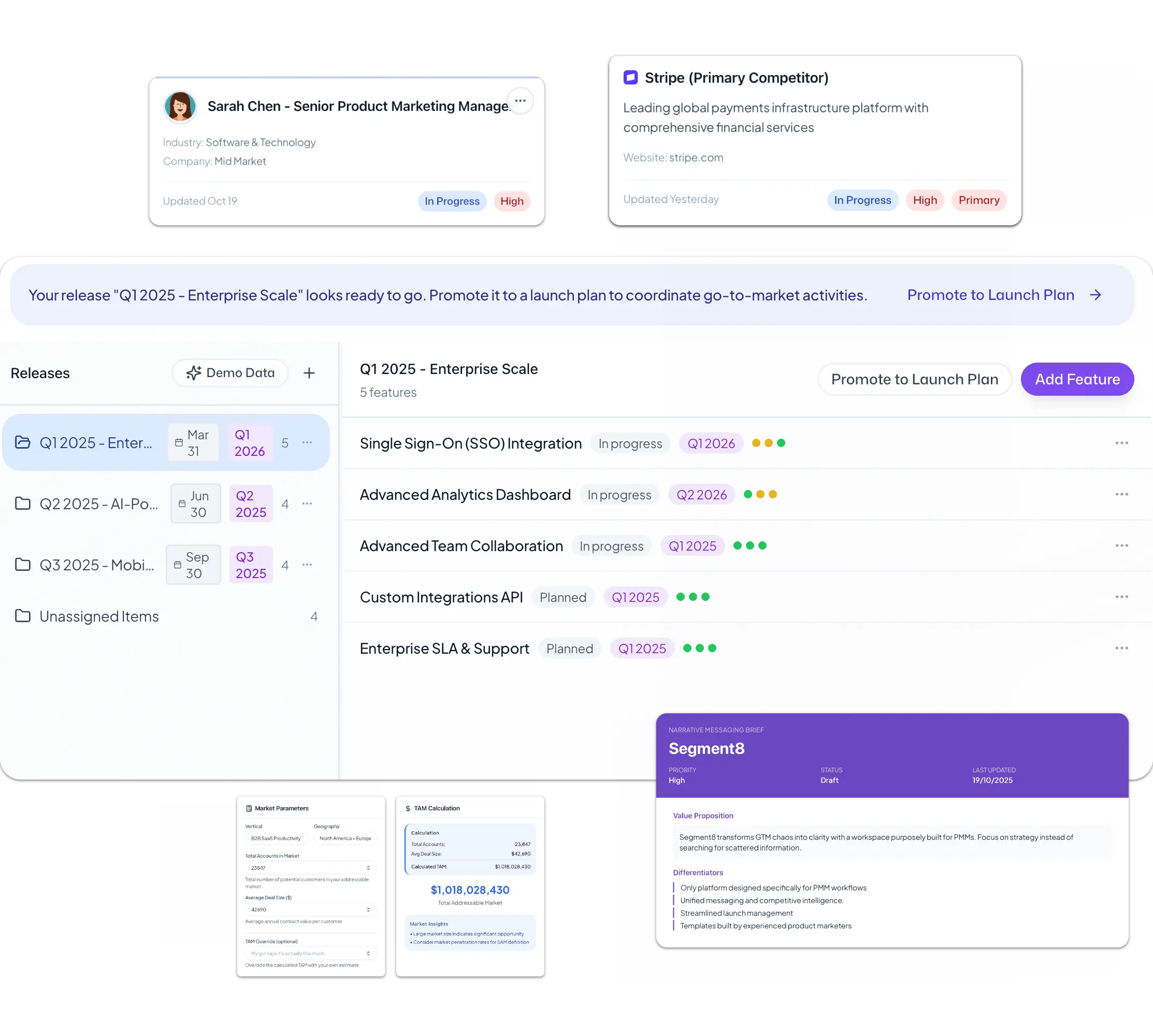

Founder, Segment8

Founder & CEO at Segment8. Former PMM leader at Procore (pre/post-IPO) and Featurespace. Spent 15+ years helping SaaS and fintech companies punch above their weight through sharp positioning and GTM strategy.

More from Market Research

Ready to level up your GTM strategy?

See how Segment8 helps GTM teams build better go-to-market strategies, launch faster, and drive measurable impact.

Book a Demo