Conjoint Analysis for Product Marketers: Understanding What Features Customers Actually Value

Learn how to use conjoint analysis to quantify customer preferences, prioritize features, and build pricing strategies based on real trade-off data rather than stated preferences.

Your customer surveys say they want everything. Advanced analytics? Yes. Enterprise security? Absolutely. Mobile app? Of course. Real-time collaboration? Why not. When you ask customers what features they value, they rarely say no.

The problem isn't that customers are lying. It's that surveys ask the wrong question. "Do you want Feature X?" isn't how buying decisions work. Real decisions involve trade-offs: "Would you pay $50 more per month for Feature X, or would you rather have Feature Y included at the base price?"

That's where conjoint analysis comes in. It's a research methodology that forces customers to make realistic trade-offs between features, pricing, and product attributes. Instead of asking what they want, it reveals what they value enough to actually pay for.

What Is Conjoint Analysis?

Conjoint analysis presents customers with realistic product configurations and asks them to choose between options or rank their preferences. Each configuration varies by attributes like features, price, brand, or service level.

By analyzing which combinations customers prefer, you can mathematically calculate the relative value they place on each attribute. This tells you not just what customers want, but how much they value it compared to alternatives.

For example, instead of asking "Do you want SSO?" you'd show:

- Option A: Core product + SSO at $99/month

- Option B: Core product + Advanced analytics at $99/month

- Option C: Core product at $79/month

If most customers choose Option A, you know SSO is worth the $20 premium. If they choose C, you know neither feature justifies the price increase.

Types of Conjoint Analysis

Choice-based conjoint (CBC) is the most common approach. You show respondents 3-5 product options and ask which they'd choose. This mirrors real purchase decisions and produces reliable results with 300-500 respondents.

Adaptive conjoint adjusts questions based on previous answers, making it efficient for complex products with many attributes. It works well for technical products but requires specialized software and larger sample sizes.

Max-diff analysis asks respondents to pick the most and least important items from a list. It's simpler to design than full conjoint but provides less detailed trade-off data.

For most B2B product marketers, choice-based conjoint offers the best balance of accuracy, cost, and ease of implementation.

How to Design a Conjoint Study

Start by identifying 4-6 attributes that vary across your product or competitive set. Common B2B SaaS attributes include price, specific features, support level, contract terms, and integrations.

For each attribute, define 2-4 levels. For price, you might test $49, $99, and $149 per month. For support, you might test email-only, email + chat, and dedicated success manager.

Your conjoint study software will generate product configurations that systematically vary these attributes. A typical study shows respondents 12-15 choice tasks, each presenting 3-4 product options.

Keep it realistic. If you're testing enterprise software, don't include a $9/month price point. If certain feature combinations don't make sense together, exclude them from your design.

Test your survey with 5-10 internal stakeholders first. If people find it confusing or unrealistic, your results won't be valid.

Analyzing Conjoint Results

The output is a set of utility scores showing the relative value customers place on each attribute level. Higher scores mean higher preference.

You can use these utilities to calculate several key metrics:

Feature importance: What percentage of the purchase decision is driven by each attribute? This tells you whether customers care more about price, specific features, or service levels.

Willingness to pay: How much revenue would you gain or lose by adding or removing a feature? This directly informs pricing and packaging decisions.

Market simulation: If you launched Product A versus Competitor's Product B, what market share would you capture? This tests positioning and feature prioritization.

Segment analysis: Do enterprise customers value different attributes than SMB customers? This reveals whether you need different product tiers or messaging for different segments.

Common Mistakes in Conjoint Studies

Testing too many attributes overwhelms respondents and produces unreliable data. If you have 10 potential features to test, run two separate studies with different feature sets rather than one massive study.

Unrealistic attribute combinations undermine credibility. Don't show "Enterprise security + $19/month pricing" if that would never exist. Use prohibited pairs or conditional logic to prevent nonsensical combinations.

Ignoring your actual market means testing with the wrong respondents. If you sell to IT directors at companies with 500+ employees, surveying small business owners will produce useless results.

Poor attribute level design happens when levels aren't meaningfully different. Testing $97 versus $99 pricing won't reveal much. Test $79, $99, and $129 instead.

Skipping validation is risky. Compare conjoint results to actual purchase data or win/loss analysis. If conjoint says Feature X is highly valued but win/loss shows it's rarely mentioned, dig deeper.

When to Use Conjoint Analysis

Use conjoint when you're making high-stakes decisions about product direction, pricing, or packaging where you need quantitative validation.

It's ideal for:

- Pricing new products or features when you don't have usage data

- Prioritizing product roadmap when you have more feature requests than capacity

- Designing product tiers and determining which features go in which package

- Testing competitive positioning by including competitor attributes

Don't use conjoint for:

- Simple yes/no decisions that don't involve trade-offs

- Qualitative discovery of unknown pain points (use interviews instead)

- Decisions where you already have strong behavioral data from existing customers

- Situations where you can't recruit enough qualified respondents (you need 300+ for reliable results)

Getting Started with Conjoint

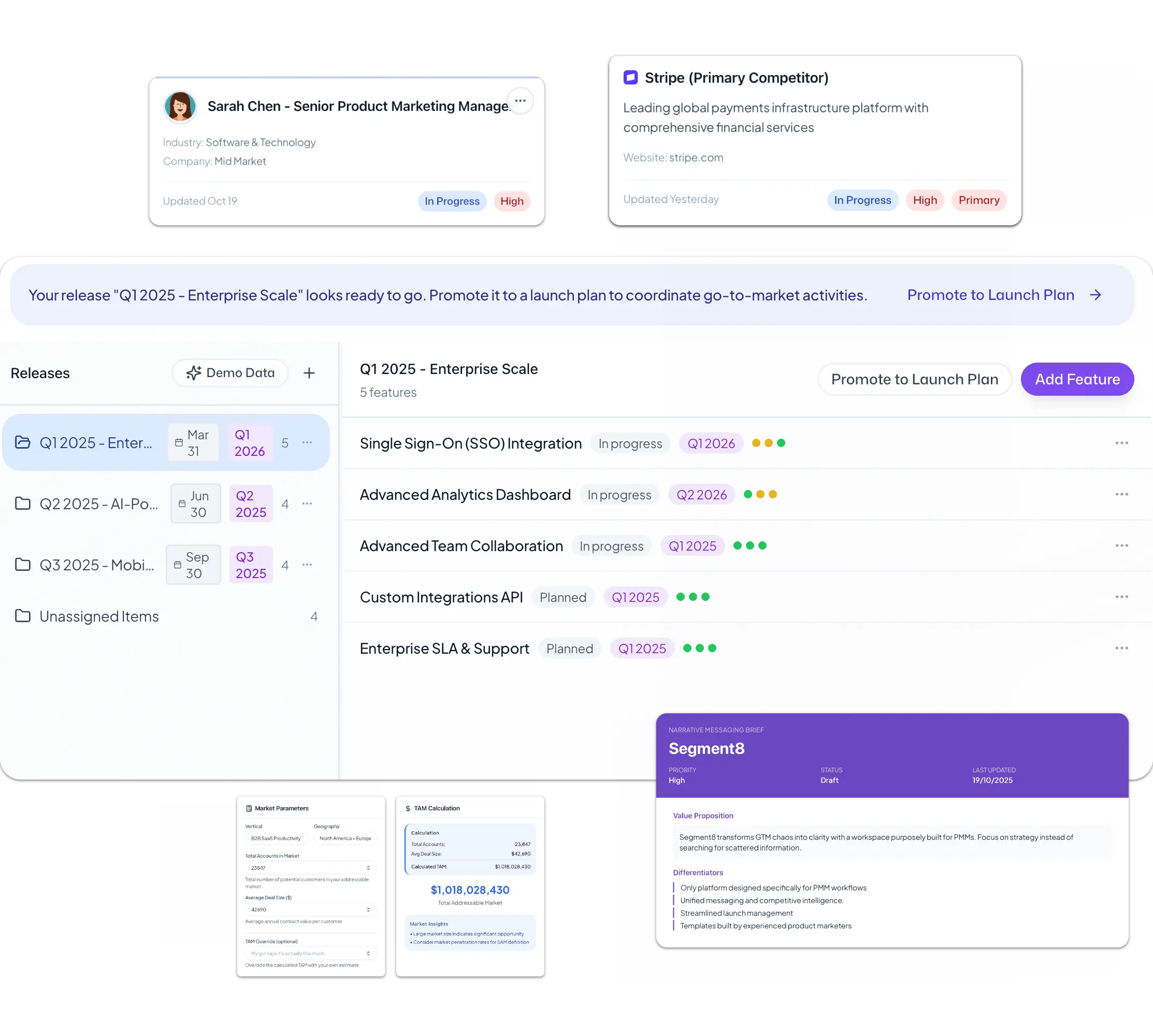

Begin with a clear research question: "Should we add SSO to our Professional plan or keep it Enterprise-only?" or "Which three features should we prioritize for Q3?"

Identify your key attributes and levels. Map out what product configurations you want to test. Sketch out 2-3 example choice tasks to ensure they're realistic.

Choose your research tool. Qualtrics and Sawtooth Software are industry standards. Conjointly and 1010data offer more affordable options for smaller studies.

Recruit 300-500 respondents from your ICP. You can use your house list, customer panels like UserTesting or Respondent.io, or B2B panels like Lucid or Cint.

Field the survey for 1-2 weeks, analyze results, and translate findings into product and pricing decisions. Share utility scores and market simulations with product, sales, and leadership teams.

Conjoint analysis won't tell you everything about your customers. But when you need to quantify trade-offs and understand relative value, it's one of the most powerful research methodologies available to product marketers.

Kris Carter

Founder, Segment8

Founder & CEO at Segment8. Former PMM leader at Procore (pre/post-IPO) and Featurespace. Spent 15+ years helping SaaS and fintech companies punch above their weight through sharp positioning and GTM strategy.

More from Market Research

Ready to level up your GTM strategy?

See how Segment8 helps GTM teams build better go-to-market strategies, launch faster, and drive measurable impact.

Book a Demo