Building Business Cases That Win Budget Using Market Research

Market research isn't just for strategy decks. Here's how to use market intelligence to build compelling business cases that get projects approved and funded.

You need budget for a new initiative—launching in a new segment, building a product feature, hiring specialists, or running a campaign. You put together a business case with projected ROI, competitive analysis, and strategic rationale. Finance comes back: "These assumptions aren't validated. Request denied."

The problem isn't your math. It's that internal logic and projections don't convince stakeholders who see dozens of funding requests quarterly. What changes their minds is external validation: market evidence that your initiative addresses real demand with predictable returns.

After building business cases at four companies—from product investments to market expansion to GTM strategy shifts—I've learned the pattern: the business cases that get approved use market research to transform assumptions into evidence. Here's how to build cases that win budget.

Why Most Business Cases Fail

Typical business case structure:

- Problem statement: Here's what we want to do

- Financial projection: Here's the ROI we expect

- Resource requirement: Here's what we need

- Risk assessment: Here's what could go wrong

This structure makes logical sense but fails to persuade because it's based on internal assumptions:

- "We project 20% conversion rate" (Based on what?)

- "Market size is $500M" (Says who?)

- "Customers will pay $50K" (Have you asked them?)

- "Implementation takes 6 months" (Compared to what?)

Stakeholders hear these and think: "You're guessing and calling it a forecast."

Market research transforms assumptions into validated claims.

The Market-Validated Business Case Structure

Part 1: Market evidence of demand (replaces problem statement)

Don't say: "We think customers want this"

Say: "Here's evidence customers are actively looking for this and currently have no good options"

How to show this:

Search volume analysis: "Google Keyword Planner shows 12,000 monthly searches for '[solution]' with growing trend (+40% YoY)"

Competitive validation: "Three funded competitors raised $X in last 18 months specifically to address this, suggesting VC-validated market demand"

Customer interviews: "We interviewed 25 target customers. 18 (72%) said they have budget allocated for this problem right now but don't have satisfactory solutions"

Sales pipeline evidence: "In Q3, 23% of our prospects asked if we offer [capability]. We lost 4 deals specifically because we don't have it"

This proves demand exists independently of your opinion.

Part 2: Market-validated financial model (replaces projection)

Don't say: "We estimate $2M revenue opportunity"

Say: "Based on comparable market data, here's the revenue range we expect with confidence intervals"

How to build this:

Comparable company analysis:

"[Company X] entered similar segment in 2022, reached $3M ARR within 18 months. [Company Y] launched similar product, achieved $1.8M in year one. Based on our relative advantages [specific differences], we model $2M-2.5M conservative range."

Customer willingness-to-pay research:

"We surveyed 50 target customers using Van Westendorp pricing method. Results show:

- Acceptable price range: $30K-$60K

- Optimal price point: $42K

- 65% would purchase at this price point

- Our addressable segment: 2,000 companies

- Conservative penetration (5%): 100 customers × $42K = $4.2M TAM"

Existing customer expansion data:

"We analyzed our 200 current customers. 47 (23.5%) match the profile of this segment. If we apply similar penetration to target market, that's 23.5% × 2,000 companies = 470 potential customers."

External data makes your numbers defensible, not just optimistic.

Part 3: Market-benchmarked resource requirements (replaces resource request)

Don't say: "We need 5 people and $500K"

Say: "Based on how similar initiatives were resourced at comparable companies, here's what's required"

How to validate this:

Industry benchmarks:

"Gartner data shows B2B SaaS companies entering [segment] typically allocate 2-3 dedicated sales reps per $1M target revenue. For our $2M goal, that's 4-6 reps. We're requesting 5 (mid-range)."

Competitive intel from job posts:

"We analyzed hiring patterns of [Competitors X, Y, Z] when they launched similar initiatives. Average team composition: 3 sales, 1 SE, 1 PMM, 1 CSM. We're requesting similar structure."

Advisor validation:

"We consulted with [Advisor Name], former VP Sales at [Company], who led similar expansion. Their recommended team structure and budget aligns with our request."

Showing you've researched appropriate resourcing level makes asks credible.

Part 4: Market-contextualized risk assessment (replaces risk section)

Don't say: "This might not work"

Say: "Here's what caused similar initiatives to fail elsewhere and how we're mitigating those specific risks"

How to frame this:

Failure pattern analysis:

"We studied 8 companies that attempted similar expansion:

- 3 succeeded (common factor: launched with X)

- 5 struggled (common factor: lacking Y) We're replicating success patterns and avoiding documented failure modes"

Market timing validation:

"Analyst reports show [trend] adoption at 35% in target segment, up from 12% two years ago. This suggests market maturity is reaching tipping point. Historical data shows 30-40% penetration is optimal entry point."

Competitive movement:

"In last 6 months, [Competitors A and B] invested in this segment (evidenced by team hiring and positioning shifts). This validates market opportunity and creates urgency—waiting longer risks competitive disadvantage."

Contextualized risks feel manageable. Abstract risks feel scary.

The Research Methods That Strengthen Cases

Method 1: Win/loss analysis

Shows what's already costing you revenue.

"Our win/loss data shows:

- Lost 8 deals in last quarter to status quo because we lack [capability]

- Average deal size for these losses: $65K

- Total lost revenue: $520K/quarter = $2.1M annually

- This initiative addresses the #1 reason for status quo losses"

This proves the opportunity cost of not acting.

Method 2: Customer advisory board feedback

Gets buy-in from customers who matter most.

"We presented this concept to our Customer Advisory Board (15 customers representing $3.2M in ARR):

- 12 of 15 would expand spend if we offered this

- Average estimated additional spend: $18K/customer

- Committed expansion opportunity from CAB alone: $216K"

When your best customers say they'll pay for it, Finance listens.

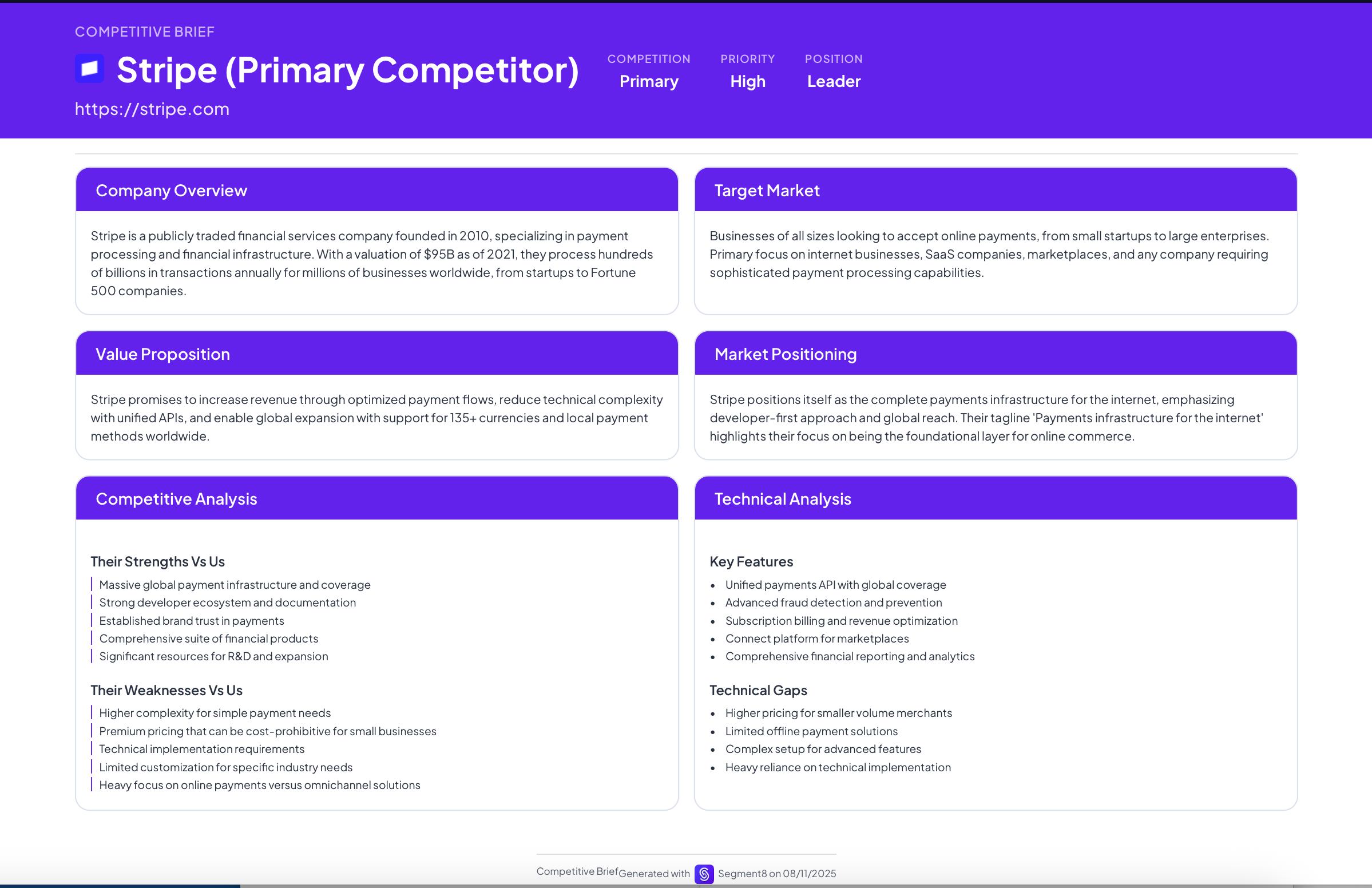

Method 3: Competitive feature gap analysis

Shows where you're losing ground.

"Feature gap analysis of top 3 competitors:

- Competitor A: Launched [capability] 8 months ago, now standard in all plans

- Competitor B: Announced this on roadmap for Q2

- Competitor C: Acquired company specifically for this capability

- Our sales team reports: 15 recent deals where this came up; we lost 9 of those

- Projected deal wins with parity: 60% instead of 40% = +$X revenue"

Competitive pressure creates urgency.

Method 4: Market sizing from first principles

Bottom-up validation of TAM/SAM.

"Market size validation:

- LinkedIn Sales Navigator: 2,847 companies matching ICP (specific filters documented)

- Average spending on category (per Gartner): $35K annually

- TAM: 2,847 × $35K = $99.6M

- Realistic penetration (based on sales capacity): 3% = $3M

- Conservative year-one target (30% of 3%): $900K"

Defensible sizing beats aspirational claims.

The One-Page Executive Summary Format

Most business cases are too long. Executives want one page:

[Initiative Name] Business Case

Market Opportunity: [One paragraph with external validation] "Customer interviews (n=25), competitive analysis, and sales pipeline data show [specific demand]. Market size: [validated number] with [X%] growing YoY per [source]."

Financial Model: [Table with sources]

| Metric | Conservative | Moderate | Optimistic | Source |

|---|---|---|---|---|

| Target customers | 80 | 120 | 160 | LinkedIn filters |

| Close rate | 20% | 30% | 40% | Comparable co. data |

| Avg deal size | $40K | $50K | $60K | Customer WTP research |

| Year 1 revenue | $640K | $1.8M | $3.8M | Calculated |

Resource Requirements: [Benchmarked ask] "Based on industry standard ratios and competitive team composition analysis: [X people], [Y budget]. Details in appendix."

Success Criteria: [Measurable milestones] "Quarter 1: 5 pilot customers. Quarter 2: $200K pipeline. Quarter 3: 2 closed deals. Kill criteria: If below 50% of targets by Q2."

Key Risks & Mitigations: [External context] "Risk 1: [X]. Mitigation: [Similar companies succeeded by doing Y, we're replicating]. Risk 2: [Z]. Mitigation: [Market data shows A, which addresses this]."

Everything fits on one page. Everything is externally validated. Everything is actionable.

Common Mistakes That Kill Business Cases

Mistake 1: Only using internal data

Internal data (our conversion rates, our customer segments) isn't trusted for new initiatives. Mix internal with external validation.

Mistake 2: Cherry-picking research

If you only cite research that supports your case and ignore contradictory data, stakeholders assume you're biased. Address counter-evidence directly.

Mistake 3: Vague market sizing

"The market is $5B" (from random analyst report) isn't useful. "We identified 2,300 specific companies we can target with $X average spend" is.

Mistake 4: No downside scenario

Only showing upside projections kills credibility. Model conservative case and show it still makes sense.

The Follow-Up That Seals Approval

After submitting the business case:

Offer to workshop assumptions:

"I know the financial model has assumptions. Happy to walk through each one and show the research behind it. Let me know specific areas you want to pressure-test."

This invites scrutiny instead of fearing it.

Provide customer access:

"Three customers from our research offered to speak with Finance/Exec team to validate demand. Can arrange 15-minute calls if helpful."

Decision-makers trust customer voices more than yours.

Start small and prove it:

"If full investment feels risky, we could pilot with 2 people and $50K to validate assumptions. Hit milestones, then scale."

Reducing initial risk often wins approval when big bets don't.

Measuring Business Case Quality

Before submitting, stress-test:

The source test: Every major claim has external validation cited The skeptic test: Could someone arguing against this case point to unvalidated assumptions? The comparison test: Does this look more credible than typical business cases your company sees? The action test: Does the case make the decision obvious, or does it require faith?

Great business cases make stakeholders think "this is so well-researched we'd be foolish not to do it."

Market research doesn't guarantee approval. But it transforms your case from opinion-based to evidence-based. That's the difference between budget requests that die in finance review and initiatives that get funded and supported. Research the market, validate assumptions, and let external evidence make your argument. Your opinion isn't persuasive. Market reality is.

Kris Carter

Founder, Segment8

Founder & CEO at Segment8. Former PMM leader at Procore (pre/post-IPO) and Featurespace. Spent 15+ years helping SaaS and fintech companies punch above their weight through sharp positioning and GTM strategy.

More from Market Research

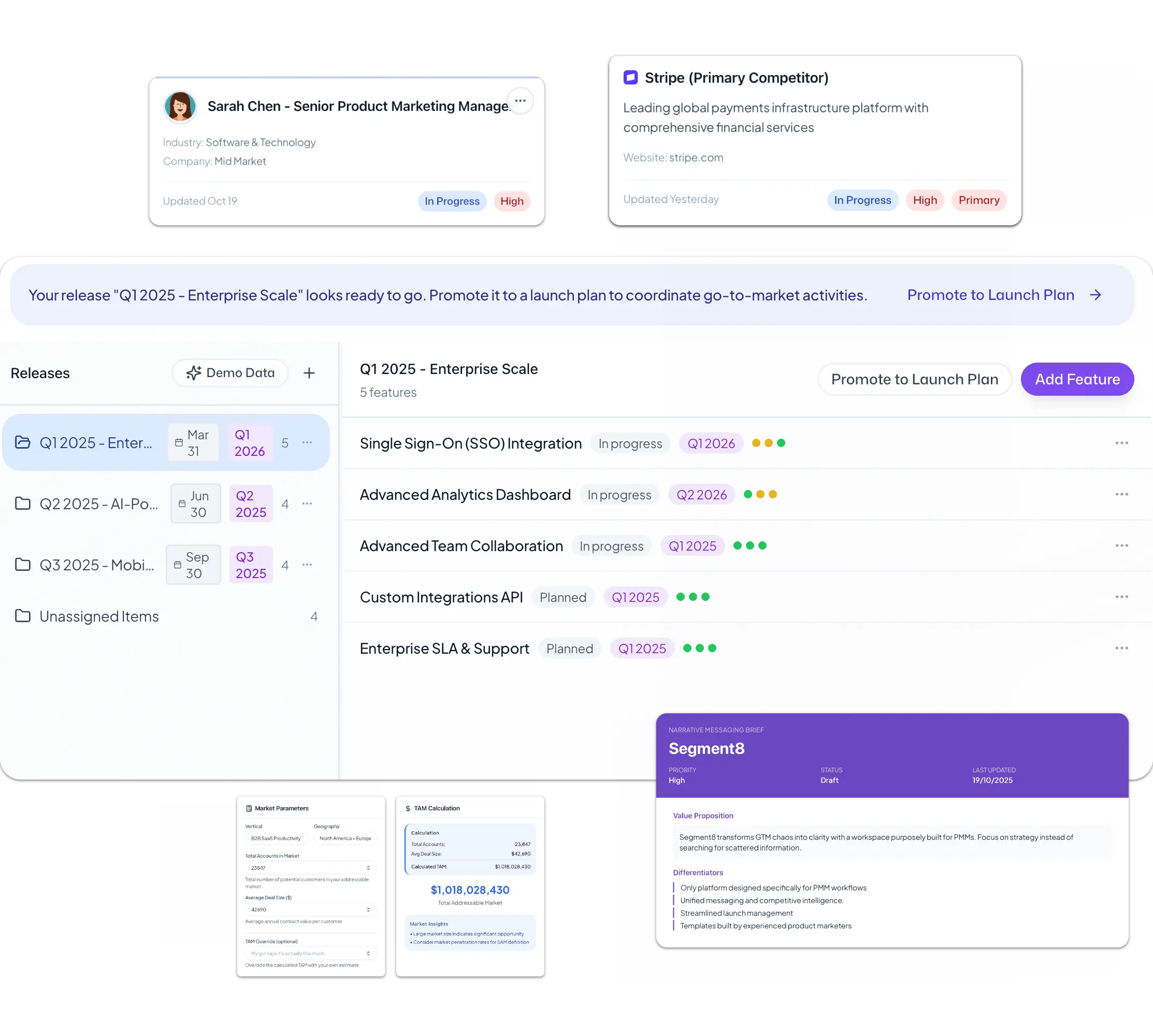

Ready to level up your GTM strategy?

See how Segment8 helps GTM teams build better go-to-market strategies, launch faster, and drive measurable impact.

Book a Demo