Voice of Customer Programs That Don't Require Dedicated Headcount

You don't need a research team to run systematic customer feedback programs. Here's how to build VOC into existing workflows without adding headcount.

Every product marketing framework emphasizes "voice of customer" as critical. Most companies interpret this as "we need to hire someone to run customer research." Budget isn't approved. Research doesn't happen. Decisions get made based on opinions and assumptions instead of customer evidence.

The problem isn't lack of willingness to listen to customers. It's treating VOC as a dedicated function instead of a distributed practice. You don't need researchers running formal programs. You need systematic ways to capture and synthesize customer intelligence that's already happening across sales, support, success, and product.

After building voice of customer systems at three companies without dedicated research teams, I've learned the pattern: effective VOC isn't about formal research studies. It's about creating lightweight capture mechanisms and regular synthesis routines that surface customer insights from existing interactions.

Here's how to build VOC programs that actually work with the team you already have.

Why Formal VOC Programs Fail at Small Companies

Most VOC frameworks come from enterprise companies with dedicated research teams and assume resources most companies don't have:

- User research team conducting quarterly studies

- Customer advisory boards with structured meeting cadences

- Dedicated customer insights analyst synthesizing feedback

- Research budget for incentives, tools, and external vendors

When a 50-person company tries to implement this, it fails immediately. Nobody has time. Research doesn't happen consistently. After six months, the "VOC program" is abandoned.

The alternative isn't abandoning customer feedback. It's designing VOC systems that leverage conversations already happening instead of creating new research infrastructure.

The Three-Layer VOC System

Layer 1: Passive capture (0 extra work)

Build systems that automatically capture customer feedback from existing interactions without requiring additional effort from your team.

Layer 2: Embedded questions (5 minutes extra per interaction)

Add systematic questions to interactions your team is already having—sales calls, onboarding sessions, support tickets, renewal conversations.

Layer 3: Intentional outreach (1-2 hours monthly)

Structured customer conversations that do require dedicated time, but scheduled routinely and rotated across team members so no single person owns them.

Most companies jump to Layer 3 (formal research) without building Layer 1 and 2. Start at Layer 1.

Layer 1: Passive Capture Systems

Sales call recording analysis

If you use Gong, Chorus, or similar tools, you're already recording sales calls. Set up keyword tracking for:

- Competitor mentions (which alternatives prospects evaluate)

- Feature requests (what capabilities they ask about)

- Pain points (problems they're trying to solve)

- Buying criteria (what affects their decision)

Weekly routine: PMM reviews highlights (15 minutes). Tool surfaces relevant segments automatically. This captures market intelligence from dozens of prospect conversations with zero additional work from sales team.

Support ticket tagging

Most support systems (Zendesk, Intercom, Help Scout) support tagging. Create tags for:

- Feature requests

- Integration needs

- Workarounds customers build

- Competitive comparisons

- Churn risk signals

Monthly routine: Review tag distribution (20 minutes). Rising tag volume signals emerging themes. "Integration with [tool X]" requested 40 times this month vs. 12 last month = market signal.

NPS/CSAT analysis (if you're already collecting it)

Don't just track score. Read the comments. Segment by:

- Detractors vs. promoters (what separates them?)

- Customer segment (different personas have different needs)

- Time since purchase (satisfaction changes over lifecycle)

Monthly routine: Read 20 random comments from each score range (30 minutes). Look for themes, not outliers.

Customer Slack/community monitoring

If you have customer Slack, community forum, or user group:

- Note questions that come up repeatedly

- Track feature requests mentioned organically

- Observe which customers are power users (they become interview targets)

- Identify pain points customers help each other solve

Weekly routine: Skim community activity (10 minutes). Flag themes for synthesis.

These passive systems require setup time initially but run continuously with minimal ongoing effort.

Layer 2: Embedded Questions

Sales discovery calls: Add two questions

Work with sales leadership to add two questions to discovery call templates:

-

"Before you started looking for a solution, what finally made you think 'we need to change something'?" (Reveals trigger events and pain points)

-

"Besides us, what other solutions are you evaluating and why?" (Reveals competitive set and differentiation factors)

Sales reps ask these anyway. Making them consistent means you can analyze patterns across 50 discovery calls instead of treating each as unique.

Customer onboarding calls: Add one question

CSMs already do onboarding calls. Add this to every kickoff:

"What's the one outcome that, if we achieve it in the first 90 days, would make you consider this implementation successful?"

This reveals what customers actually care about (often different from what sales sold or what product thinks matters).

Support ticket close: Add optional feedback

When closing high-priority tickets, support asks:

"Quick question: Is this issue something you've experienced with other tools, or is it specific to [product]?"

This identifies whether you have unique bugs or category-wide problems. If 30% say "we had same issue with [previous tool]," you're dealing with category limitation, not product defect.

Renewal conversations: Add one question

When CS discusses renewal (60 days before), ask:

"What's one thing we could change that would make you more likely to expand vs. just renew?"

This reveals expansion blockers and whitespace opportunities.

These embedded questions add minutes to conversations already happening. The customer insights come at near-zero incremental cost.

Layer 3: Intentional Outreach

Monthly win/loss interviews (2 hours/month total)

Pick 2 recent wins and 2 recent losses. Have PMM or founder conduct 20-minute interviews:

For wins: "Walk me through what made you choose us over alternatives."

For losses: "I know you went with [competitor]. Can I ask what made them the better fit?" (Most people will tell you if you ask genuinely)

Rotate who conducts these (PMM one month, product lead next month, sales leader the next). This distributes effort and ensures insights reach different functions.

Quarterly customer deep-dives (2 hours/quarter)

Pick 3 customers who represent different segments or use cases. 30-minute interviews asking:

- "How has your usage of [product] evolved since you started?"

- "What have you stopped using and why?"

- "What would make you use it more/differently?"

- "If you were designing this for your team, what would you change?"

These deep-dives reveal usage patterns and opportunities surveys miss.

Bi-annual churned customer interviews (1 hour every 6 months)

Reach out to customers who churned 3-6 months ago. Enough time has passed that they're willing to be honest.

"We're trying to improve. Would you spend 15 minutes telling me what we got wrong?"

Churned customers are brutally honest in ways active customers aren't. This is the most valuable feedback you'll get.

The Synthesis Routine That Makes It Useful

Collecting feedback is pointless without synthesis. Create a monthly ritual:

Last Friday of every month (90 minutes):

Step 1: Aggregate inputs (30 minutes)

- Review sales call highlights from Gong

- Pull top support ticket themes

- Read NPS comments from latest survey

- Scan customer Slack for recurring topics

- Review notes from any win/loss or customer interviews

Step 2: Identify themes (30 minutes)

Group inputs into categories:

- Product gaps: Features customers need that don't exist

- Positioning insights: How customers describe your value differently than you do

- Market intelligence: Competitive threats, buying criteria changes, budget trends

- Risk signals: Churn indicators, satisfaction drops, competitor wins

Step 3: Create action items (30 minutes)

For each theme, assign owner and next step:

- Product gap → Product lead: Evaluate for roadmap

- Positioning insight → PMM: Update messaging

- Market intelligence → Sales: Update battle cards

- Risk signal → CS: Proactive outreach to similar customers

Output: One-page VOC summary

Share with exec team and all customer-facing teams:

What we heard this month:

- [Theme 1] mentioned by X customers across sales, support, and success

- [Theme 2] appeared in Y% of win/loss interviews

- [Theme 3] trending up in support volume

What we're doing about it:

- [Action 1 - Owner - Timeline]

- [Action 2 - Owner - Timeline]

This synthesis ritual is more valuable than any individual research study because it triangulates across multiple sources and shows patterns.

Tools You Already Have (No New Budget Required)

For call recording: Gong, Chorus, Fireflies (free tier) For support tagging: Zendesk, Intercom, Help Scout (existing tools) For survey analysis: Typeform, Google Forms (free) For synthesis: Google Doc, Notion, Confluence (free) For scheduling interviews: Calendly (free), email

You don't need UserTesting, Qualtrics, or dedicated research platforms to run effective VOC.

How to Know It's Working

Effective VOC changes decisions. Track these signals:

Product decisions reference customer evidence

Roadmap discussions cite "23 customers requested this in last quarter" instead of "we think users would like this."

Sales enablement reflects market reality

Battle cards get updated based on competitive intel from deals, not assumptions about competitors.

Positioning evolves with customer language

Your homepage starts using phrases customers use to describe their problems instead of internal jargon.

Churn becomes predictable and preventable

CS identifies at-risk customers earlier because you recognize early warning signals from pattern analysis.

If these aren't happening, your VOC inputs aren't reaching decision-makers. Fix the synthesis and distribution, not the collection.

When to Finally Hire Dedicated Research

You need dedicated VOC headcount when:

- Customer base exceeds 500 accounts (too much signal for distributed capture)

- You're in regulated industry requiring formal research compliance

- You're entering new markets and need structured primary research

- Win rate is declining and you don't know why (need deep diagnostic work)

Until then, distributed VOC with systematic synthesis beats having one researcher who becomes a bottleneck.

Voice of customer isn't a research function. It's a company practice. Build it into existing workflows, create synthesis rituals, and use customer evidence to drive every major decision. You don't need headcount. You need systems and discipline.

Kris Carter

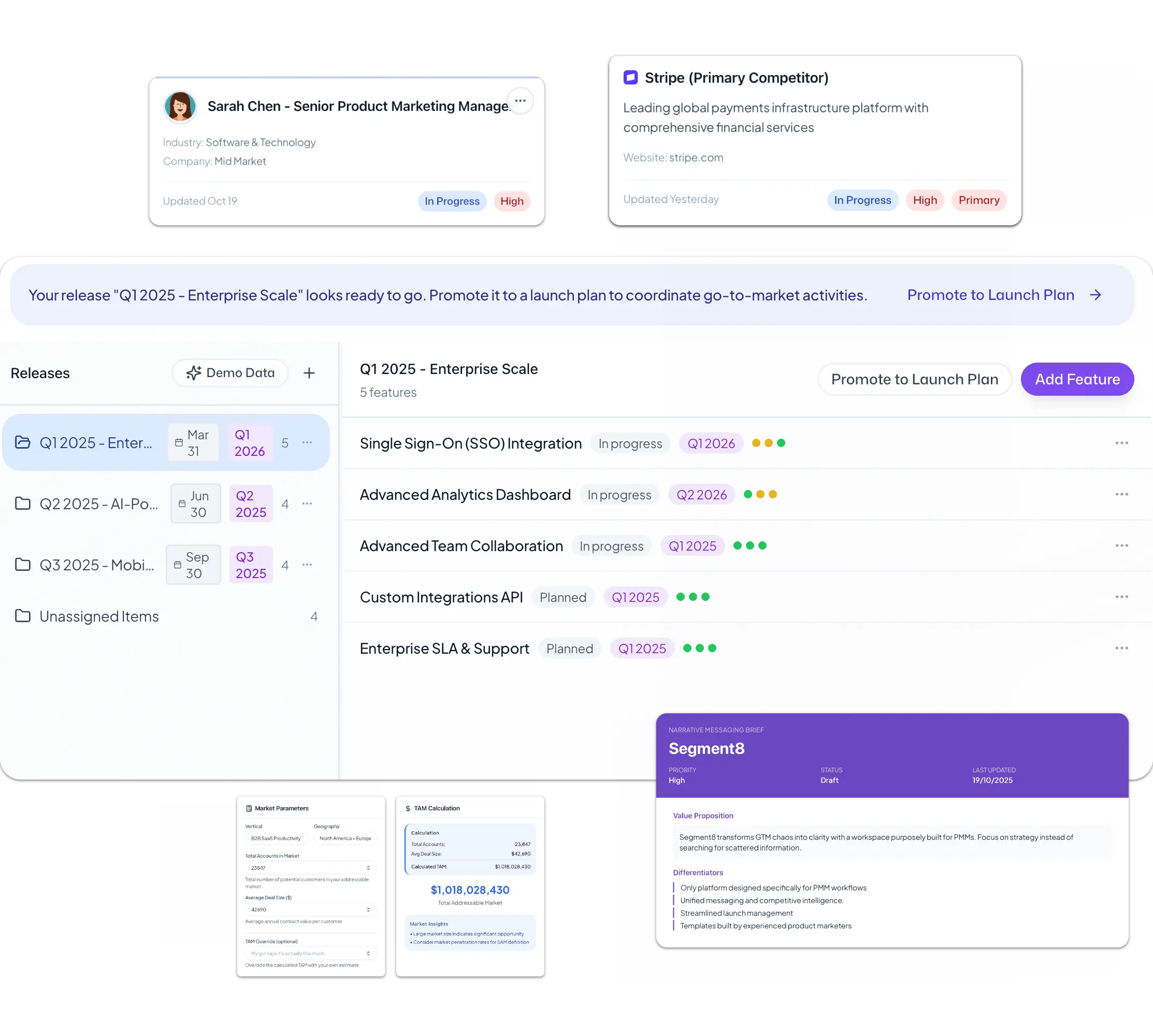

Founder, Segment8

Founder & CEO at Segment8. Former PMM leader at Procore (pre/post-IPO) and Featurespace. Spent 15+ years helping SaaS and fintech companies punch above their weight through sharp positioning and GTM strategy.

More from Market Research

Ready to level up your GTM strategy?

See how Segment8 helps GTM teams build better go-to-market strategies, launch faster, and drive measurable impact.

Book a Demo