Market Entry Strategy: How to Expand into New Segments Without Diluting Focus

Expanding into adjacent segments can accelerate growth or destroy focus. Here's how to evaluate and execute market expansion strategically.

Your product is working for mid-market SaaS companies. Sales asks why you can't sell to enterprises—bigger deals, similar needs. Marketing wants to target e-commerce—adjacent vertical, large market. Product suggests financial services—willing to pay premium prices.

You have one sales team, one product roadmap, and one marketing budget. Expanding into all three dilutes resources and confuses positioning. Choosing wrong segment wastes 12 months. Choosing right segment accelerates growth 3x.

After leading segment expansion at three companies—one that tripled revenue in 18 months, two that stalled for a year before refocusing—I've learned the pattern: successful segment expansion requires ruthless prioritization, systematic validation, and staged investment. Random expansion kills more companies than focused execution.

Here's how to expand deliberately.

Why Most Segment Expansion Fails

Mistake 1: Expanding because you can, not because you should

"Our product works for segment X, so let's target segment Y too" ignores that winning in new segments requires segment-specific investment in product, sales, marketing, and support.

Mistake 2: Expanding into segments that look attractive but don't match capabilities

Enterprise segment has big budgets but requires enterprise sales team, longer sales cycles, different product requirements, and customer success model your company may not be ready for.

Mistake 3: Trying to serve multiple segments simultaneously

Most companies don't have resources to master two segments at once. Splitting focus means mediocre execution in both instead of dominance in one.

The Segment Selection Framework

Step 1: Map potential segments

List all segments you could theoretically serve:

By company size:

- SMB (1-50 employees)

- Mid-market (50-500 employees)

- Enterprise (500+ employees)

By industry vertical:

- Financial services

- Healthcare

- Retail/e-commerce

- Manufacturing

- Technology/SaaS

By use case:

- Department-specific (marketing, sales, engineering)

- Company-wide (HR, IT, finance)

By geography:

- Domestic expansion (new regions in home country)

- International expansion (new countries)

Don't filter yet. Just map all possibilities.

Step 2: Score each segment on strategic fit

Rate each potential segment on these five factors (1-5 scale):

Product fit: How much product adaptation is required?

- 5 = Works out of box

- 3 = Needs 2-3 features

- 1 = Requires significant rebuild

Sales motion alignment: Can current sales team sell this?

- 5 = Same sales process works

- 3 = Needs training but similar motion

- 1 = Requires completely different sales approach

Market timing: Is segment actively buying now?

- 5 = High buyer intent, allocated budgets

- 3 = Some activity, emerging demand

- 1 = Category education required

Competitive intensity: How crowded is segment?

- 5 = Underserved, few good alternatives

- 3 = Competitive but fragmented

- 1 = Dominated by entrenched leaders

Economic value: Revenue potential vs. acquisition cost

- 5 = High ACV, reasonable CAC

- 3 = Moderate ACV, moderate CAC

- 1 = Low ACV, high CAC

Scoring example:

| Segment | Product | Sales | Timing | Competition | Economics | Total |

|---|---|---|---|---|---|---|

| Enterprise | 3 | 2 | 4 | 3 | 5 | 17 |

| E-commerce | 4 | 4 | 5 | 2 | 4 | 19 |

| Financial services | 2 | 3 | 4 | 4 | 5 | 18 |

E-commerce scores highest. Start there.

Step 3: Validate top segment with real data

Don't trust scoring alone. Test assumptions:

Product fit validation: Interview 10 companies in target segment. Demo current product. Ask:

- "What would prevent you from using this today?"

- "What's missing that you'd need?"

- "How does this compare to what you're using now?"

If 70%+ say "we could use this with minor changes," product fit is real.

Sales motion validation: Have sales team run 5 discovery calls with target segment. Different from current segment?

- Same pain points?

- Same buying committee?

- Same sales cycle length?

If yes to all three, sales motion aligns.

Economic validation: Research 20 companies in segment:

- What do they currently spend on category?

- What's their budget cycle?

- Who controls budget?

If average spending is 2x+ your current ACV, economics are favorable.

Competitive validation: Identify top 3 competitors serving this segment.

- What are their weaknesses? (G2 reviews, customer interviews)

- Where are they vulnerable?

- What would make segment switch?

If you can exploit meaningful competitive gaps, you can win share.

The Staged Entry Approach

Don't commit full resources immediately. Stage investment based on proof points.

Stage 1: Validate (90 days, minimal investment)

Goal: Prove segment will buy

Activities:

- Target 20 companies in segment with outbound

- Run 10 discovery calls

- Convert 2-3 to pilot customers

- Gather product feedback

Investment:

- 1 sales rep part-time

- Basic segment-specific marketing materials

- No product changes yet

Success criteria:

- 20%+ response rate to outreach

- 2+ pilot customers

- Clear product-market fit signal

Kill criteria:

- <10% response rate

- Can't close any pilots in 90 days

- Product gaps too significant to bridge

If success criteria met, move to Stage 2. If kill criteria met, choose different segment.

Stage 2: Prove repeatability (6 months, moderate investment)

Goal: Show you can sell consistently

Activities:

- Dedicated sales rep for segment

- Build segment-specific product features (top 2-3 gaps)

- Create segment case studies and content

- Develop segment-specific pitch and demo

Investment:

- 2 sales reps full-time

- 1 SE or sales engineer

- Product roadmap allocation (20% of sprint capacity)

- Marketing budget for segment campaigns

Success criteria:

- Close 8-10 customers in segment

- Win rate above 30%

- Customer retention above 85%

Pivot criteria:

- Can't maintain pipeline

- Win rate below 20%

- Churn above 25%

If success criteria met, move to Stage 3. If pivot criteria met, refine approach or choose different segment.

Stage 3: Scale (12+ months, full investment)

Goal: Dominate segment

Activities:

- Build dedicated segment sales team

- Create segment-specific product version if needed

- Full marketing investment in segment

- Segment-specific customer success

Investment:

- 5-10 sales reps

- Dedicated marketing campaign budget

- Product team segment focus

- Customer success segment specialization

Success criteria:

- 50+ customers in segment within 18 months

- Recognized as top 3 vendor in segment

- Efficient growth (CAC payback <12 months)

This staged approach limits downside while preserving upside.

Segment Entry Tactics That Work

Tactic 1: Leverage existing customers as bridges

If you have any customers in target segment, use them:

- Turn them into reference customers (case studies, quotes, calls)

- Ask for introductions to peers

- Feature them prominently in segment-specific marketing

Tactic 2: Hire from the segment

Bring on sales rep or marketer with deep segment relationships:

- They understand segment buying patterns

- They have network you can leverage

- They speak segment language authentically

Tactic 3: Partner with segment-specific vendors

Find non-competitive vendors dominant in target segment:

- Co-marketing partnerships

- Integration partnerships

- Referral partnerships

Their credibility in segment transfers to you.

Tactic 4: Create segment-specific proof

Don't repurpose generic content. Build segment-native assets:

- Case studies from segment companies

- ROI calculator with segment benchmarks

- Competitive comparison against segment incumbents

- Implementation guides for segment use cases

Generic content signals you're tourist, not expert.

Common Expansion Mistakes

Mistake 1: Geographic before vertical

Most B2B companies should expand vertically (new industries) before geographically (new countries). Vertical expansion shares language, currency, legal environment. Geographic expansion requires localization, regional teams, compliance adaptation.

Exception: If your current segment is dominated in domestic market and underserved internationally, geographic expansion first makes sense.

Mistake 2: Moving too far from core

Expanding from mid-market SaaS to enterprise SaaS is adjacent. Expanding from mid-market SaaS to healthcare hospitals is distant. Distant expansion requires fundamentally different capabilities.

Rule: New segment should share at least 2 of 3: similar company size, similar buying motion, similar use case.

Mistake 3: Expanding during core segment struggles

If win rates are declining, churn is rising, or growth is slowing in core segment, fix core before expanding. Expansion won't solve core problems—it dilutes resources away from fixing them.

Rule: Only expand when core segment metrics are healthy and growth is capital-constrained, not execution-constrained.

Mistake 4: Underestimating segment-specific requirements

Enterprise sales looks similar to mid-market but requires: security certifications, compliance documentation, professional services, procurement process navigation, multi-year contracts. Each adds cost and complexity.

Rule: Budget 50-100% more investment than you think segment needs. Expansion always costs more than projected.

Measuring Segment Entry Success

Leading indicators (Months 1-6):

- Outreach response rate (>15% = strong signal)

- Discovery-to-demo conversion (>40% = good fit)

- Demo-to-pilot conversion (>30% = value resonates)

Progress indicators (Months 6-12):

- Number of customers closed (8-10 = repeatability)

- Win rate (>25% = competitive)

- Average sales cycle (within 20% of core segment = process works)

Lagging indicators (Months 12-18):

- Customer retention (>85% = good fit)

- Expansion revenue (>20% of customers expand = value delivery)

- CAC payback (<12 months = economically viable)

If any metric is 30%+ below target for two consecutive quarters, either fix the issue or exit the segment.

The Expansion Decision Tree

Should you expand now?

Is core segment growing >50% YoY? → No = Fix core first → Yes = Continue

Do you have 6+ months runway at current burn? → No = Focus on revenue, not expansion → Yes = Continue

Can you staff dedicated segment team? → No = Wait until you can → Yes = Continue

Does top segment score >18/25? → No = Keep validating segments → Yes = Start Stage 1

Systematic segment expansion compounds growth. Random expansion fragments focus. Choose deliberately, validate rigorously, stage investment prudently. The right segment at the right time accelerates everything. The wrong segment burns resources and delays progress. Research and discipline make the difference.

Kris Carter

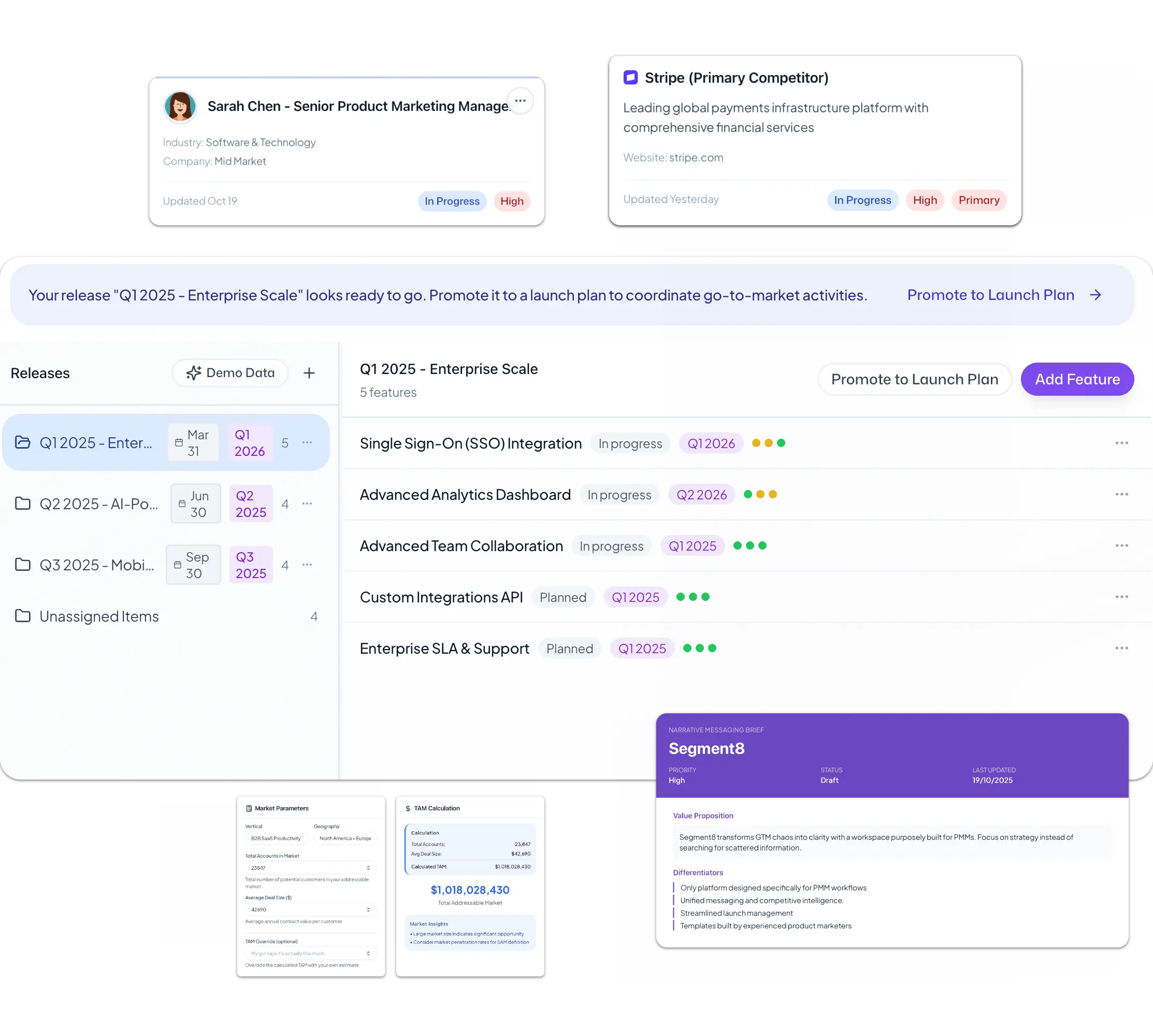

Founder, Segment8

Founder & CEO at Segment8. Former PMM leader at Procore (pre/post-IPO) and Featurespace. Spent 15+ years helping SaaS and fintech companies punch above their weight through sharp positioning and GTM strategy.

More from Market Research

Ready to level up your GTM strategy?

See how Segment8 helps GTM teams build better go-to-market strategies, launch faster, and drive measurable impact.

Book a Demo