How to Size Your Market Without Hiring a Research Firm

You don't need a $50K Gartner report to estimate market size. Here's how to build credible TAM/SAM/SOM models using free data sources and basic math.

Your board asks for market size estimates. Your sales leader needs TAM data for territory planning. Your CMO wants to know if this segment is worth targeting. And you have exactly zero budget for market research firms.

The instinct is to Google "market size for [your category]" and cite whatever Forrester or Gartner number you find. The problem: those reports are often outdated, use definitions that don't match your product, or aggregate markets so broadly they're meaningless for planning.

After building market size models at four companies—from pre-seed startups to public companies—I've learned you can create more accurate, more defensible estimates using free data and methodical bottom-up analysis than you'll get from most third-party reports.

Here's the framework that works.

The Two Approaches: Top-Down vs. Bottom-Up

Top-down modeling starts with total market size and narrows down.

Example: "The CRM market is $50B. Our segment is 15% of that. We can capture 5% share. That's $375M TAM."

This approach is fast and sounds impressive in pitch decks. It's also usually wrong because the assumptions are guesses dressed up as analysis.

Bottom-up modeling starts with unit economics and builds up.

Example: "There are 47,000 companies in North America with 100-1,000 employees in financial services. Our average deal size is $25K annually. If we could reach 20% of this segment, that's $235M TAM."

Bottom-up is harder. It requires actual research and math. But it produces numbers you can defend in board meetings and use for real planning.

Always build bottom-up first. Use top-down only to sanity-check your work.

The Bottom-Up Framework

Step 1: Define your ideal customer profile with specifics

Vague ICP: "B2B companies that need sales tools"

Specific ICP: "B2B software companies with $10M-$100M revenue, 50-500 employees, selling products with >$50K ACV and 3+ month sales cycles"

The specifics matter because they determine which data sources you can use. "Companies" is too broad. "B2B software companies with 50-500 employees" can be counted.

Step 2: Count companies that match your ICP

Free data sources that work:

- LinkedIn Sales Navigator (even free version): Filter by company size, industry, location. It shows total count.

- Crunchbase (basic free tier): Filter by funding stage, employee count, category

- ZoomInfo/Apollo free tier: Limited searches but shows market counts

- SBA/Census data: Free government databases with company counts by size and industry

- Trade association reports: Many publish member statistics publicly

Stack multiple sources to cross-verify. If LinkedIn shows 50K companies and Crunchbase shows 48K, you're in the right range.

Step 3: Estimate what percentage you could realistically reach

This is where most models break. Don't assume you can sell to 100% of companies in your ICP.

Apply realistic filters:

- Geographic reach: If you only have US sales team, exclude international (for now)

- Competitive saturation: If 60% of market already uses competitors, your addressable market is the remaining 40% plus churn/displacement opportunity

- Budget availability: What percentage of companies in your ICP actually have budget allocated for this category?

Conservative estimate: 20-30% of total ICP count is realistically addressable in first 3 years.

Step 4: Calculate revenue potential

Total addressable companies × Average deal size × Purchase frequency = Market size

Example: 15,000 addressable companies × $35K average contract × 1 purchase per year = $525M SAM

Build three scenarios: Conservative (low deal size, low reach), moderate (mid-range), aggressive (high end). Present all three with assumptions clearly stated.

How to Estimate Deal Size Without Customers

If you're pre-revenue or have limited customer data, you can still estimate deal sizes:

Method 1: Competitive pricing analysis

Find 5-10 competitors. Check their public pricing pages. Most B2B SaaS companies publish at least starting prices. Average them. Add 20% if you're more feature-rich, subtract 15% if you're lighter-weight.

Method 2: Value-based calculation

What's the annual value your product creates? Industry standard is you can charge 10-20% of value created.

Example: If your tool saves each user 5 hours per week, and they have 50 users, that's 250 hours weekly × 50 weeks × $75/hour loaded cost = $937,500 annual value. You could charge $94K-$188K at 10-20% of value.

Method 3: Budget allocation research

Talk to 10 target customers. Ask: "What do you currently budget annually for [category]?" Average their answers. This becomes your anchor for deal size.

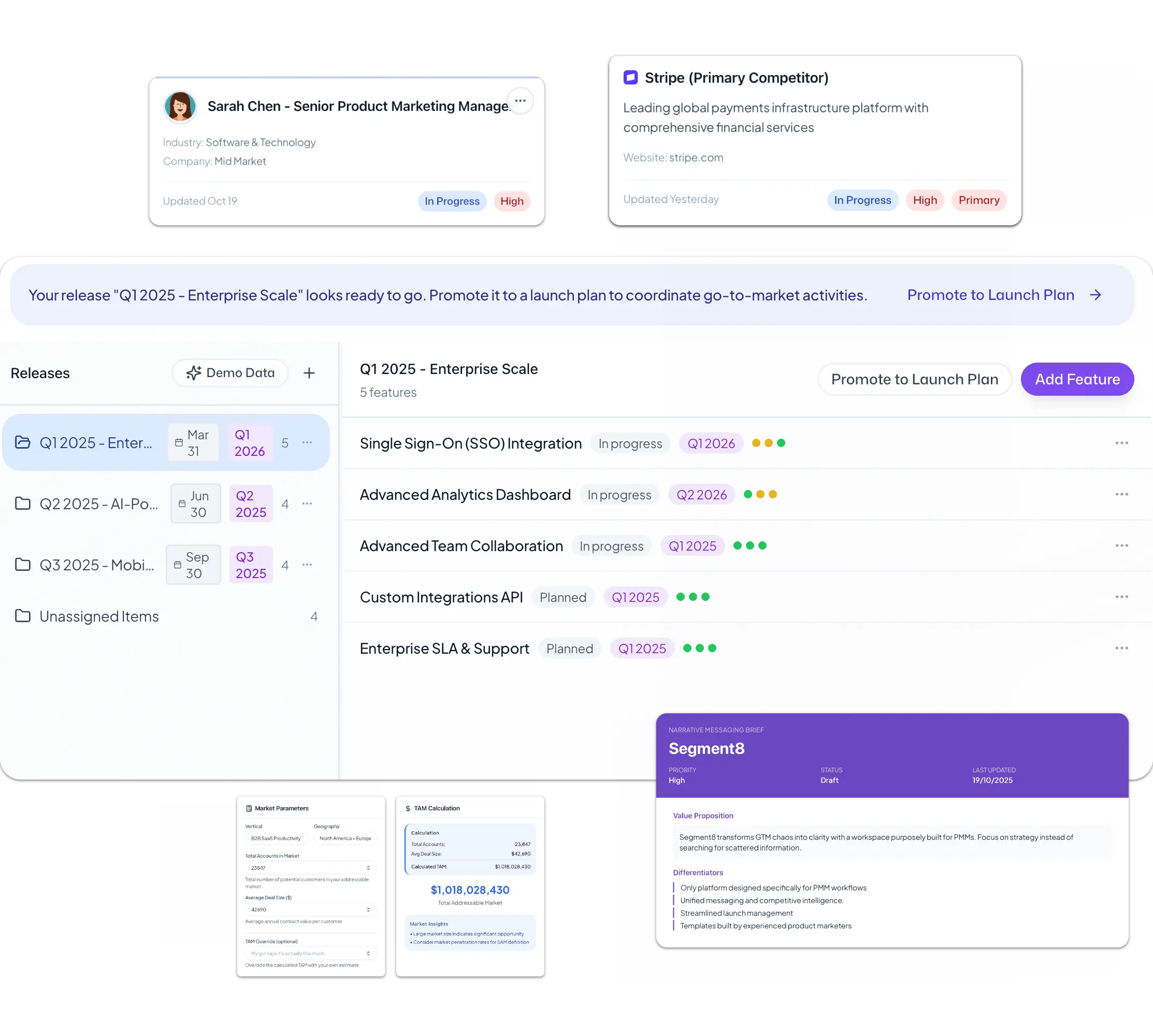

The TAM/SAM/SOM Breakdown

Once you have bottom-up numbers, structure them as TAM/SAM/SOM:

TAM (Total Addressable Market): Maximum revenue if you had 100% of all companies that could ever use your product

SAM (Serviceable Addressable Market): Revenue from segment you can realistically reach with your current product and go-to-market motion

SOM (Serviceable Obtainable Market): Revenue you can realistically capture in next 3 years given competition, sales capacity, and market maturity

Example breakdown:

- TAM: 180,000 companies globally × $30K = $5.4B

- SAM: 45,000 companies in North America with active budgets × $30K = $1.35B

- SOM: 2,500 companies you can close in 3 years × $30K = $75M

Your SOM should ladder up to your sales capacity. If you have 10 reps who can each close 20 deals annually, your year-one SOM is 200 deals, not 2,500.

How to Validate Your Numbers

Never present market sizing without validation:

Validation test 1: Expert sanity check

Share your model with 3-5 people who know the market (investors, advisors, customers). Ask: "Does this pass the smell test?" If everyone says you're off by 10x, your assumptions are wrong.

Validation test 2: Comparable company analysis

Find public companies in your space. Check their S-1 filings or investor decks. They often cite market sizes. Your numbers should be in the same ballpark, adjusted for differences in scope.

Validation test 3: Reverse engineer from current metrics

If you have any revenue, work backwards. "We have $2M ARR with 0.5% market penetration" implies a $400M market. Does that match your bottom-up model? If not, reconcile the difference.

What to Do With Third-Party Research

You'll still encounter Forrester, Gartner, IDC reports. Use them, but carefully:

Check the date. Markets shift fast. A 2022 report is stale by 2025.

Read the methodology. How did they define the market? If their definition is "all business software" and yours is "workflow automation for financial services," the numbers aren't comparable.

Extract data points, not conclusions. Third-party reports are useful for growth rates, adoption trends, and buying behavior insights. Less useful for total market size unless their definition exactly matches yours.

Making Your Model Actionable

Market sizing isn't an academic exercise. It should drive decisions:

For fundraising: Investors want to see $1B+ TAM for venture-scale outcomes. Your SAM needs to support a path to $100M+ revenue.

For sales planning: SAM divided by sales capacity tells you how many reps you can support. If your SAM is $50M and each rep can generate $1M annually, you can scale to 50 reps max.

For segment prioritization: If SMB market is $200M but enterprise is $800M, you know where to focus expansion even if SMB is easier to penetrate initially.

Build the model once properly, update it quarterly as you learn more, and use it to defend every major strategic decision.

Market sizing without research firms isn't a shortcut. It's often more accurate because you're using current data, specific definitions, and bottom-up validation instead of broad analyst estimates. The work matters. The method works.

Kris Carter

Founder, Segment8

Founder & CEO at Segment8. Former PMM leader at Procore (pre/post-IPO) and Featurespace. Spent 15+ years helping SaaS and fintech companies punch above their weight through sharp positioning and GTM strategy.

More from Market Research

Ready to level up your GTM strategy?

See how Segment8 helps GTM teams build better go-to-market strategies, launch faster, and drive measurable impact.

Book a Demo