The TAM/SAM/SOM Framework That Actually Convinces Investors

Investors hear market size claims all day. Here's how to build TAM models they'll believe and use to justify their investment thesis.

Your pitch deck has a slide that says "We're going after a $47B market." The investor barely glances at it before moving to the next slide. Later, in the rejection email, they mention "market size concerns."

The problem isn't that your market is too small. It's that your market sizing wasn't credible. Investors see dozens of TAM slides every week. Most are fantasy math: take a huge analyst report number, claim you'll capture 2%, and call it a business plan.

After working through fundraising processes at three companies and reviewing hundreds of pitch decks as an advisor, I've learned the pattern: investors don't want big TAM numbers. They want defensible TAM models that show you understand your market deeply enough to capture it.

Here's how to build market sizing that actually strengthens your fundraising case.

Why Generic TAM Claims Fail

Most TAM slides follow this formula:

"The global market for [broad category] is $X billion (Gartner, 2024). We're targeting [vague segment] which represents Y% of this market. Our TAM is therefore $Z billion."

Example: "The customer data platform market is $10B. We're targeting mid-market companies, which are 30% of spending. Our TAM is $3B."

This tells investors nothing useful. It doesn't show you understand who actually buys, what they pay, why they buy, or how you'll reach them.

Investors want to see three things in market sizing:

- Bottom-up validation that proves you've counted real companies with real budgets

- Logical market segmentation that shows where you'll win first vs. later

- Connection to GTM reality that demonstrates TAM is achievable with your go-to-market motion

The Framework Investors Actually Trust

Layer 1: Start with your beachhead (SOM)

Most founders present TAM → SAM → SOM, getting smaller. Smart founders present SOM → SAM → TAM, showing expansion path.

Start with the market you'll actually capture in the next 2-3 years:

"In our first 24 months, we're targeting B2B SaaS companies with 50-200 employees, $10M-$50M ARR, and active data teams. There are approximately 3,400 companies matching this profile in North America based on Crunchbase data cross-referenced with LinkedIn filters."

This immediately establishes credibility. You've counted actual companies with specific criteria. An investor can verify this themselves.

Layer 2: Show unit economics, not just company count

Convert company count to revenue potential:

"Our target segment uses 2-3 data tools currently at $15K-$30K annual spend each based on public pricing from Segment, Rudderstack, and mParticle. Our pricing model positions at $20K average contract value. Serviceable obtainable market: 3,400 companies × $20K × 25% achievable penetration in 3 years = $17M SOM."

The 25% penetration is the critical assumption. Defend it with:

- Sales capacity math (10 reps × 50 deals per year = 500 customers over 3 years = 15% of 3,400)

- Competitive analysis (current solutions have X% penetration in similar segments)

- Early traction (current pipeline suggests Y% of target segment shows buying intent)

Layer 3: Expand to serviceable addressable market (SAM)

Show the adjacent segments you'll expand into after proving the beachhead:

"Once we've proven traction with mid-market SaaS companies, we expand to:

- Segment 2: E-commerce companies with similar profile (+ 2,100 companies, +$10M ARR potential)

- Segment 3: Financial services companies 100-500 employees (+1,800 companies, +$12M ARR potential)

- Segment 4: Upmarket to enterprise SaaS 200-1,000 employees at higher ACV (+900 companies, +$15M ARR potential)

Total SAM: $54M across segments we can reach with similar product and GTM motion."

Each segment gets specific company counts and explains why it's adjacent to your beachhead. This shows strategic thinking, not just market aggregation.

Layer 4: Build to total addressable market (TAM)

Only now do you show the full market potential:

"TAM includes all companies globally that have the problem we solve, including markets that would require localization, verticalization, or significant product adaptation:

- Geographic expansion: Europe and APAC (2.5x North America numbers = +$135M)

- Vertical expansion: Healthcare, manufacturing, retail segments (+$85M)

- Market creation: Companies not currently in-market but will be as category matures (+$120M)

Total TAM: $394M over 10-year horizon."

This TAM is still grounded in counting. You're not citing a $50B category and claiming a slice. You're building up from your beachhead through logical expansion.

The Numbers That Make Investors Nervous

Certain TAM patterns trigger investor skepticism:

Red flag 1: TAM over $10B for a seed-stage company

If you're raising a seed round and claim a $15B TAM, it signals you don't understand your market specifically enough. Massive markets are harder to penetrate, not easier.

Better approach: Show a $200M-$800M TAM with clear path to leadership position. Investors would rather see 20% of $500M than 0.5% of $15B.

Red flag 2: SOM that's tiny relative to TAM

If your TAM is $5B but your SOM is $10M, investors wonder why your penetration is so low. Either the TAM is inflated or your GTM is weak.

Better approach: SOM should be 5-15% of SAM, and SAM should be 20-40% of TAM. This shows realistic tiering.

Red flag 3: No company count validation

"We're going after enterprises spending $X on this category" without saying how many enterprises or who they are specifically.

Better approach: "We've identified 847 companies matching our ICP using LinkedIn Sales Navigator filters: industry = software, size = 500-5000, headquartered in US/UK/Germany. Here's the saved search link."

How to Handle Top-Down vs. Bottom-Up Reconciliation

Investors often ask: "Gartner says this market is $8B. You're saying $400M. Which is right?"

Answer framework:

"Gartner defines the market as [broad category including X, Y, Z]. Our TAM is specifically [your narrow definition]. We exclude [X and Y] because [reason - different buyer, different use case, different budget]. Our $400M represents [specific segment] within their $8B total category. This is the portion we can realistically address with our product and GTM motion."

This shows you understand the broader market context but have strategically chosen a focused wedge. That's exactly what investors want to see.

Common Mistakes That Kill Credibility

Mistake 1: Using outdated analyst reports

Citing a 2019 Forrester report in a 2025 pitch deck suggests you haven't done recent research.

Fix: Use current data even if it's from free sources (LinkedIn, Crunchbase, Census data). Recency beats pedigree.

Mistake 2: Claiming market creation without precedent

"This $5B market doesn't exist yet but will exist because of our product" is almost always wrong.

Fix: Find analogous markets that show the pattern. "Adobe created $X market for Y category. Similar dynamics apply here because [specific parallels]."

Mistake 3: Ignoring competition in market sizing

If competitors have collectively raised $500M to chase a market you claim is only $200M TAM, the math doesn't work.

Fix: Size the market large enough to justify competitive investment, then explain why you'll win share.

The Backup Slides That Strengthen Your Case

Include these in your appendix (not main deck):

Slide 1: Data sources and methodology

List every source you used with dates. "Company counts: LinkedIn Sales Navigator (Oct 2025), Crunchbase Pro (Nov 2025). Pricing benchmarks: Public pricing pages from [competitors], G2 reported contract values."

Slide 2: Comparative company analysis

Show 3-5 public or recently-acquired companies in your space. Their revenue, market cap, or acquisition price validates your TAM assumptions.

Slide 3: Customer validation

Quotes from target customers confirming budget availability: "We currently spend $X on this category across Y tools and would consolidate for the right solution."

Making Market Size an Offensive Weapon

The best founders don't present TAM defensively ("here's why the market is big enough"). They present it offensively ("here's why we're positioned to dominate this market").

Framework:

- "We've identified exactly who buys this and what they pay" (specificity)

- "We're starting with the segment we can win fastest" (strategic focus)

- "We have a clear path to expand from beachhead to broader market" (growth trajectory)

- "The competitive dynamics favor new entrants because..." (market timing)

This turns market sizing from a checkbox slide into a strategic differentiator.

Your TAM model should make investors think "these founders understand their market better than anyone else pursuing it." That's when market sizing becomes a fundraising advantage, not just a required slide.

Kris Carter

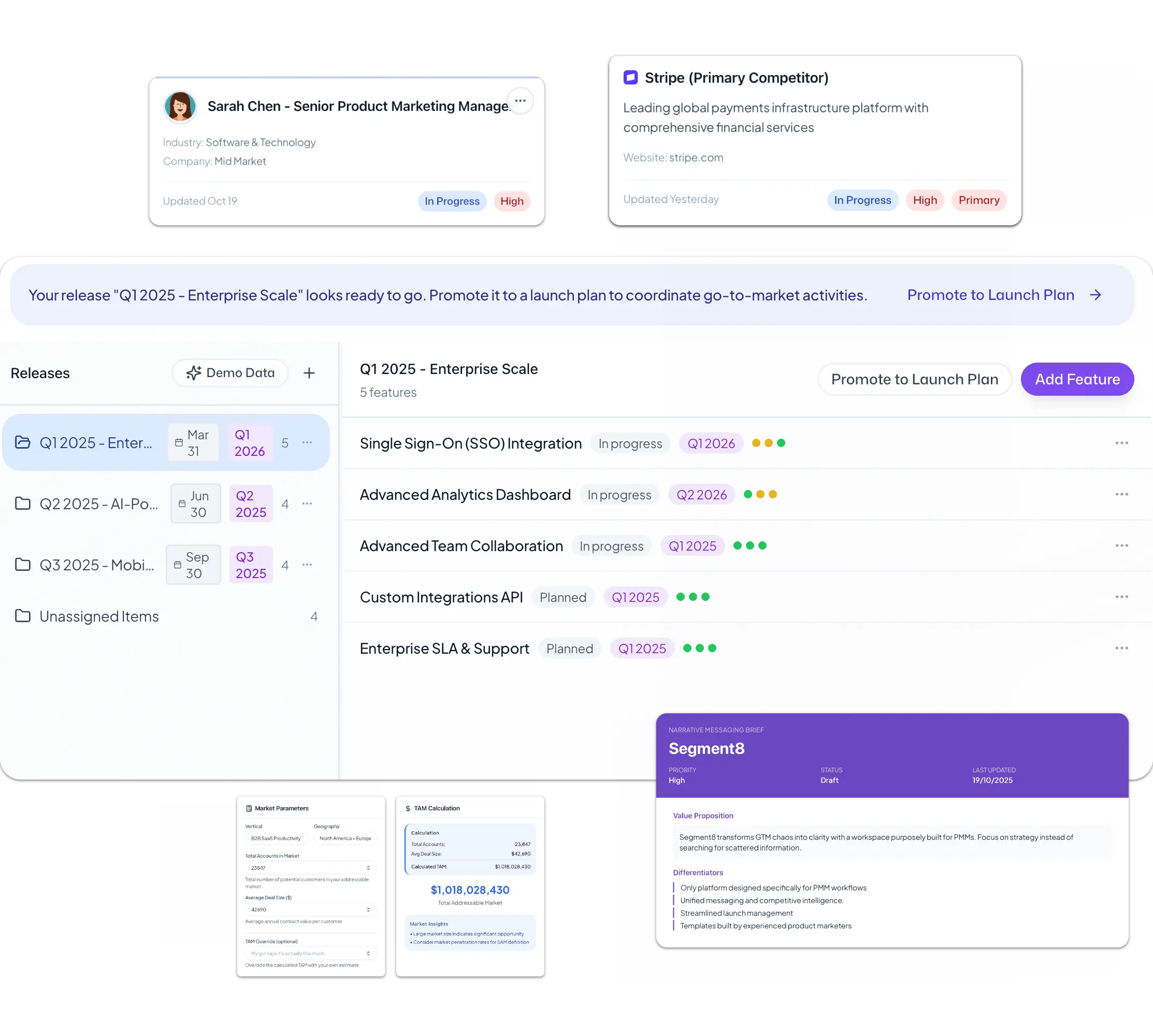

Founder, Segment8

Founder & CEO at Segment8. Former PMM leader at Procore (pre/post-IPO) and Featurespace. Spent 15+ years helping SaaS and fintech companies punch above their weight through sharp positioning and GTM strategy.

More from Market Research

Ready to level up your GTM strategy?

See how Segment8 helps GTM teams build better go-to-market strategies, launch faster, and drive measurable impact.

Book a Demo